CVX Stock: The Ultimate Guide To Chevron Corporation's Investment Potential

Hey there, fellow investor! If you've been keeping tabs on the energy sector, you've probably stumbled across CVX stock. That's right—Chevron Corporation's ticker symbol is making waves in the financial world. Whether you're a seasoned trader or just starting out, CVX stock could be a game-changer for your portfolio. So, buckle up and let's dive deep into what makes Chevron one of the most talked-about names in the energy industry.

Now, before we get into the nitty-gritty, let's set the stage. CVX stock represents one of the largest integrated energy companies globally. Chevron Corporation isn't just another oil company—it's a powerhouse that's been around for over a century. The company's influence spans the entire energy spectrum, from exploration and production to refining and marketing. With its robust financials and strategic focus on sustainability, CVX stock is definitely worth your attention.

But here's the kicker: the energy market is evolving at lightning speed. As the world transitions to cleaner energy sources, companies like Chevron are under the microscope. Investors want to know how CVX stock will fare in this new era. Will it adapt, thrive, or falter? Stick around as we break it all down for you in this comprehensive guide.

Read also:Kate Middleton Shines In London Despite The Cold

What is CVX Stock?

Let's start with the basics. CVX stock is the publicly traded equity of Chevron Corporation, a multinational energy corporation headquartered in San Ramon, California. Founded in 1879, Chevron has grown into one of the world's leading energy companies. But what exactly does CVX stock represent? Simply put, when you buy CVX stock, you're purchasing a stake in Chevron's vast operations.

Chevron's business is divided into two main segments: upstream and downstream. The upstream segment focuses on exploring and producing crude oil and natural gas, while the downstream segment handles refining, marketing, and transportation. This diversified approach helps insulate CVX stock from the volatility of oil prices. Plus, Chevron's strong balance sheet and disciplined capital allocation strategy make it an attractive option for long-term investors.

Why Should You Care About CVX Stock?

Okay, so you might be wondering, "Why should I even bother with CVX stock?" Well, there are several compelling reasons. First and foremost, Chevron has a proven track record of delivering solid returns. Over the past decade, CVX stock has consistently outperformed its peers in the energy sector. And let's not forget about those juicy dividends. Chevron boasts one of the highest dividend yields in the S&P 500, making it a favorite among income investors.

But it's not just about the numbers. Chevron is also at the forefront of the energy transition. The company has committed to reducing its carbon footprint and investing in renewable energy projects. This forward-thinking approach positions CVX stock well for the future. As governments around the world push for cleaner energy solutions, Chevron's strategic investments could pay off big time.

Key Financial Metrics of CVX Stock

Let's talk numbers, shall we? Here are some key financial metrics that make CVX stock stand out:

- Market Capitalization: Over $200 billion

- Dividend Yield: Approximately 4-5% annually

- Price-to-Earnings Ratio: Around 7-10x

- Debt-to-Equity Ratio: Less than 0.25

These figures highlight Chevron's financial strength and stability. A low debt-to-equity ratio means the company isn't overly leveraged, which reduces risk for investors. And that dividend yield? It's a major draw for those looking for steady income streams.

Read also:Kym Johnson Spills The Beans On Her Hilarious Twin Pregnancy

The Energy Transition and CVX Stock

As the world shifts towards renewable energy, traditional oil companies like Chevron face a unique challenge. How do you balance short-term profits with long-term sustainability? CVX stock is tackling this question head-on. Chevron has set ambitious targets to reduce its greenhouse gas emissions and increase its investments in low-carbon technologies.

One of the company's key initiatives is its focus on carbon capture and storage (CCS). By investing in CCS projects, Chevron aims to capture and store carbon dioxide emissions, preventing them from entering the atmosphere. This technology could play a crucial role in mitigating climate change while still allowing Chevron to profit from fossil fuels.

Renewable Energy Projects

But it's not just about mitigating emissions. Chevron is also investing in renewable energy sources like wind and solar. The company has announced plans to spend billions of dollars on renewable energy projects over the next decade. These investments could diversify Chevron's revenue streams and reduce its reliance on oil and gas.

Of course, the success of these projects remains to be seen. But one thing's for sure: CVX stock is positioning itself for a future where renewable energy plays a bigger role. By hedging its bets on both traditional and renewable energy sources, Chevron is showing that it's serious about sustainability.

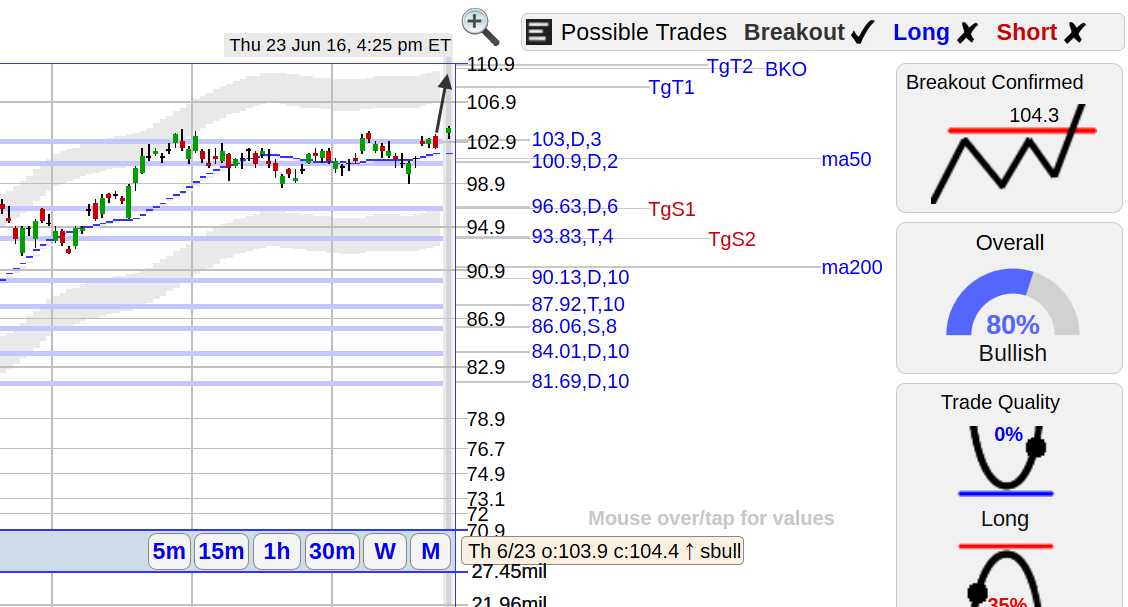

CVX Stock Performance

Now, let's talk about how CVX stock has performed in recent years. Despite the challenges faced by the energy sector, Chevron has managed to deliver impressive results. Over the past five years, CVX stock has outperformed the S&P 500 by a significant margin. This outperformance can be attributed to Chevron's disciplined approach to capital allocation and its focus on cost efficiency.

But what about the future? Analysts remain bullish on CVX stock, citing its strong balance sheet and strategic investments in low-carbon technologies. Many believe that Chevron's ability to adapt to changing market conditions will continue to drive shareholder value. Of course, there are risks involved, but the potential rewards make CVX stock an attractive option for long-term investors.

Volatility and Risk

Let's be real for a second. The energy sector is inherently volatile, and CVX stock is no exception. Oil prices can swing wildly based on geopolitical events, supply and demand dynamics, and regulatory changes. This volatility can make CVX stock a risky proposition for some investors.

However, Chevron's diversified business model helps mitigate some of these risks. The company's downstream operations, for example, tend to perform well even when oil prices are low. This diversification provides a level of stability that many other energy companies lack. Still, investors should be aware of the risks and do their due diligence before jumping into CVX stock.

CVX Stock vs. Competitors

So, how does CVX stock stack up against its competitors? To answer that question, let's compare Chevron to some of its biggest rivals in the energy sector. Companies like ExxonMobil, Royal Dutch Shell, and BP are all vying for market share in the global energy landscape. But Chevron has a few key advantages that set it apart.

For starters, Chevron's cost structure is among the most efficient in the industry. The company has consistently delivered industry-leading returns on capital employed (ROCE), a key metric for evaluating energy companies. Additionally, Chevron's focus on sustainability gives it an edge over some of its competitors, many of whom have been slower to embrace the energy transition.

Dividend Comparison

When it comes to dividends, CVX stock is in a league of its own. Chevron's dividend yield is significantly higher than that of its peers, making it an attractive option for income investors. The company has also maintained a streak of consecutive annual dividend increases, a testament to its financial strength and commitment to shareholders.

Of course, no investment is without risk. While CVX stock's dividend is impressive, investors should be aware of the factors that could impact future payouts. Economic downturns, regulatory changes, and shifts in energy demand could all affect Chevron's ability to maintain its dividend. That said, the company's strong financial position provides a level of comfort for dividend investors.

Analyst Outlook on CVX Stock

What do the experts think about CVX stock? Most analysts are bullish, citing Chevron's strong financials and strategic focus on sustainability. Many believe that the company's investments in low-carbon technologies will pay off in the long run, positioning CVX stock for growth in a rapidly changing energy market.

However, not everyone is convinced. Some analysts have raised concerns about the risks associated with the energy transition. They argue that Chevron's reliance on oil and gas could become a liability as the world moves towards cleaner energy sources. While these concerns are valid, they don't tell the whole story. Chevron's diversified business model and commitment to sustainability suggest that the company is well-prepared for the future.

Price Target and Valuation

So, what's the price target for CVX stock? Analysts have set a range of price targets, with some predicting significant upside over the next few years. The average price target currently sits around $200 per share, representing a potential upside of 20-30% from current levels.

When it comes to valuation, CVX stock looks attractive compared to its peers. The company's price-to-earnings (P/E) ratio is below the industry average, suggesting that the stock may be undervalued. Additionally, Chevron's strong balance sheet and disciplined capital allocation strategy provide a level of safety that many investors find appealing.

Final Thoughts on CVX Stock

Alright, let's wrap things up. CVX stock represents a compelling investment opportunity in the energy sector. With its strong financials, strategic focus on sustainability, and impressive dividend yield, Chevron is well-positioned for long-term success. Of course, there are risks involved, but the potential rewards make CVX stock worth considering for any investor looking to add energy exposure to their portfolio.

So, what's next? If you're interested in CVX stock, I encourage you to do your own research and consult with a financial advisor. Remember, investing is all about balancing risk and reward. By staying informed and making smart decisions, you can position yourself for success in the ever-changing world of finance.

Call to Action

Before you go, I'd love to hear your thoughts on CVX stock. Are you considering adding it to your portfolio? Or do you have concerns about the energy transition and its impact on Chevron's future? Leave a comment below and let's start a conversation. And don't forget to share this article with your fellow investors—knowledge is power!

Table of Contents

Article Recommendations