IBM Stock Price: Your Ultimate Guide To Understanding And Maximizing Your Investment

IBM stock price has become a buzzword in the financial world, especially as tech giants continue to dominate the market. Whether you're a seasoned investor or just starting your financial journey, understanding the nuances of IBM's stock is crucial. In this guide, we'll dive deep into what makes IBM stock so unique and why it's worth your attention. So, buckle up and let's explore the world of IBM stock price together!

Investing in stocks can be both exciting and intimidating, especially when you're dealing with a company as iconic as IBM. Known for its innovations and legacy in the tech industry, IBM offers a fascinating opportunity for investors. But before you jump in, you need to understand what drives the IBM stock price and how it can impact your portfolio.

This article will walk you through everything you need to know about IBM stock price, from its historical performance to future projections. We'll also touch on the factors that influence the stock, how to analyze it, and tips for making informed investment decisions. Let's get started!

Read also:Pining For Kim Full Video The Buzz The Facts And The Inside Scoop

Understanding IBM Stock Price: The Basics

First things first, let's break down what IBM stock price actually means. Simply put, it's the current value of one share of IBM on the stock market. This price fluctuates based on supply and demand, economic conditions, and company performance. For investors, monitoring IBM stock price is essential because it directly affects your potential returns.

Key Factors Influencing IBM Stock Price

Several factors can influence the IBM stock price, and it's important to stay updated on these to make smart investment decisions.

- Economic Indicators: The overall health of the economy can have a significant impact on IBM stock price.

- Company Performance: Quarterly earnings reports, new product launches, and strategic partnerships can all affect the stock price.

- Market Sentiment: Sometimes, investor sentiment can drive the stock price up or down, regardless of the company's actual performance.

Historical Performance of IBM Stock Price

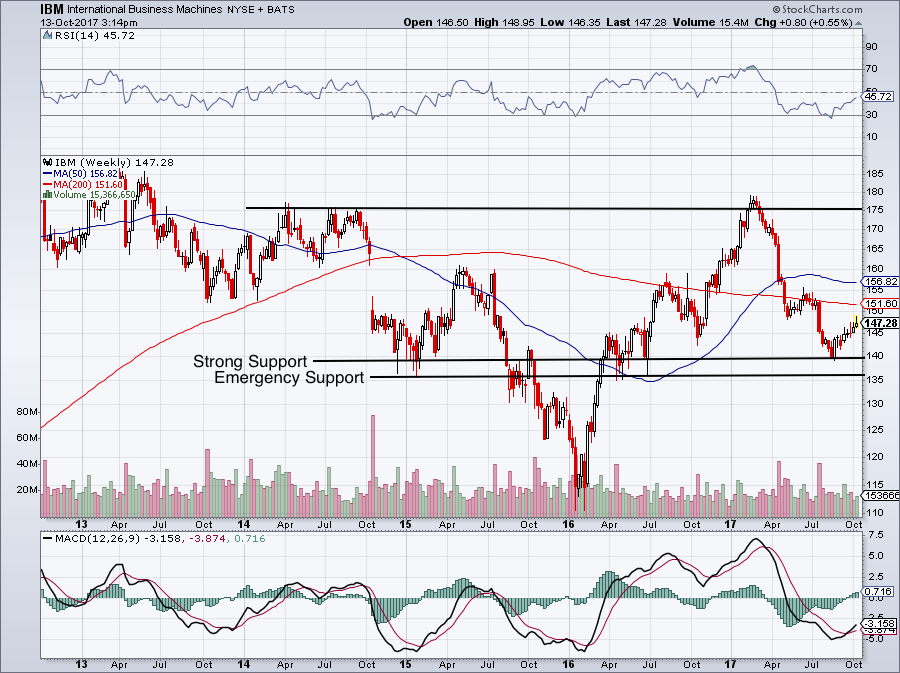

Looking back at IBM's historical stock performance gives us valuable insights. Over the years, IBM has seen both highs and lows, reflecting the dynamic nature of the tech industry. Understanding this history can help you predict future trends and make better investment choices.

IBM Stock Price Trends Over the Last Decade

Let's take a quick look at how IBM stock price has performed over the last decade. This period has been marked by significant technological advancements and shifts in the market landscape.

- 2013-2015: IBM faced some challenges, causing the stock price to dip slightly.

- 2016-2018: The company rebounded with new innovations, leading to a steady increase in stock price.

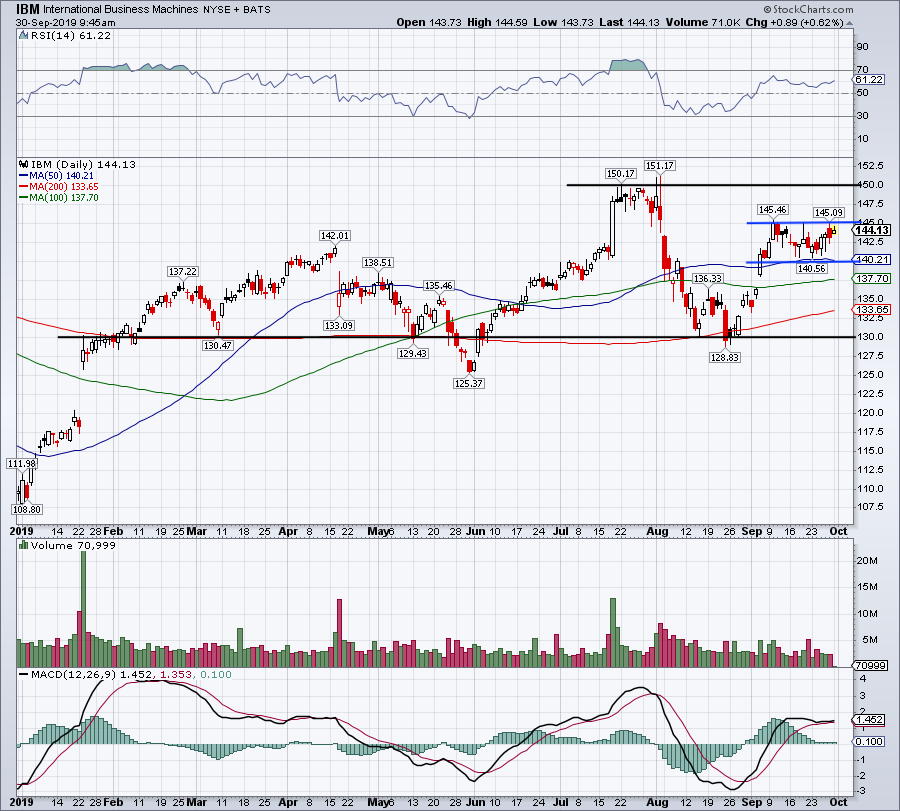

- 2019-Present: IBM has continued to grow, with the stock price reflecting its resilience and adaptability.

How to Analyze IBM Stock Price

Analyzing IBM stock price involves more than just looking at the numbers. You need to consider various analytical tools and methods to get a comprehensive view.

Technical Analysis vs. Fundamental Analysis

There are two main approaches to analyzing IBM stock price: technical analysis and fundamental analysis.

Read also:Unveiling The Truth About Vegamovisecom Your Ultimate Movie Streaming Guide

Technical Analysis: This involves studying past market data, primarily price and volume, to predict future price movements. Tools like charts and indicators are commonly used.

Fundamental Analysis: This focuses on evaluating the intrinsic value of the stock by examining financial statements, management, and market conditions.

Current IBM Stock Price and Market Outlook

As of the latest data, IBM stock price is performing well, reflecting the company's strong market position and innovative strategies. Analysts are optimistic about its future, citing potential growth in cloud computing and artificial intelligence sectors.

Predicting Future IBM Stock Price Movements

Predicting stock price movements is never an exact science, but there are signs that suggest IBM could continue to thrive. With ongoing investments in cutting-edge technologies, IBM is well-positioned to capitalize on emerging market opportunities.

Investment Strategies for IBM Stock Price

Now that you have a better understanding of IBM stock price, let's talk about how to invest in it effectively. There are several strategies you can consider based on your financial goals and risk tolerance.

Long-Term vs. Short-Term Investment

Long-Term Investment: If you're looking to build wealth over time, investing in IBM for the long haul could be a smart move. The company's history and strategic focus suggest steady growth potential.

Short-Term Investment: For those seeking quick gains, trading IBM stock based on market fluctuations might be appealing. However, this approach comes with higher risks.

IBM Stock Price in Relation to Competitors

It's also important to compare IBM stock price with its competitors in the tech industry. Companies like Microsoft, Amazon, and Google are often benchmarked against IBM, providing valuable context for investors.

Comparative Analysis of Tech Stocks

When comparing IBM with other tech giants, consider factors like revenue growth, profit margins, and market share. This comparative analysis can help you gauge IBM's competitive advantage and potential for growth.

Risks Associated with IBM Stock Price

No investment is without risks, and IBM stock price is no exception. Understanding these risks is crucial for making informed decisions.

Potential Challenges for IBM Stock Price

Some of the potential challenges include:

- Market Volatility: The stock market can be unpredictable, affecting IBM stock price.

- Technological Disruptions: Rapid changes in technology could pose challenges to IBM's business model.

- Global Economic Factors: Economic downturns or geopolitical tensions can impact IBM stock price.

Benefits of Investing in IBM Stock Price

Despite the risks, there are numerous benefits to investing in IBM stock price. The company's strong brand, diversified portfolio, and commitment to innovation make it an attractive option for many investors.

Why IBM Stock Price is Worth Considering

IBM offers several advantages, including:

- Stable Dividends: IBM has a history of paying consistent dividends, which can be appealing to income-focused investors.

- Innovative Solutions: With a focus on AI, cloud computing, and other emerging technologies, IBM is well-positioned for future growth.

- Global Reach: IBM's extensive global presence provides diverse revenue streams.

Conclusion: Is IBM Stock Price Right for You?

In conclusion, IBM stock price presents a compelling opportunity for investors looking to tap into the tech sector. By understanding the factors that influence the stock, analyzing its performance, and considering your investment goals, you can make informed decisions.

We encourage you to share your thoughts and experiences with IBM stock price in the comments below. Additionally, don't forget to explore other articles on our site for more insights into the world of finance and investing. Together, let's navigate the exciting journey of building wealth and achieving financial success!

Table of Contents

- Understanding IBM Stock Price: The Basics

- Key Factors Influencing IBM Stock Price

- Historical Performance of IBM Stock Price

- How to Analyze IBM Stock Price

- Current IBM Stock Price and Market Outlook

- Investment Strategies for IBM Stock Price

- IBM Stock Price in Relation to Competitors

- Risks Associated with IBM Stock Price

- Benefits of Investing in IBM Stock Price

- Conclusion: Is IBM Stock Price Right for You?

Article Recommendations