Meta Earnings: Unlocking The Power Of Meta’s Financial Performance

Meta earnings have become a hot topic in the world of tech and finance. If you're wondering why everyone's talking about it, you're not alone. Meta Platforms Inc., formerly known as Facebook, has been making waves with its financial performance. From record-breaking revenue streams to cutting-edge innovations, Meta's earnings report is a goldmine of information for investors and tech enthusiasts alike. So, buckle up and get ready to dive into the nitty-gritty of Meta's financial success.

Let’s face it, the world of tech giants is all about numbers, and Meta is no exception. Whether you’re a seasoned investor or just someone curious about how these massive companies operate, understanding Meta earnings can give you a clearer picture of where the future of digital innovation is headed. It’s not just about making money; it’s about shaping the digital landscape.

Now, before we jump into the deep end, let’s set the stage. This article will break down everything you need to know about Meta earnings, from the basics to the advanced stuff. We’ll explore what makes Meta so profitable, how its earnings compare to other tech giants, and what the future holds for this powerhouse. Ready? Let’s go!

Read also:How Did Roz Varons Daughter Passed Away A Heartfelt Look Into The Tragedy

What Are Meta Earnings?

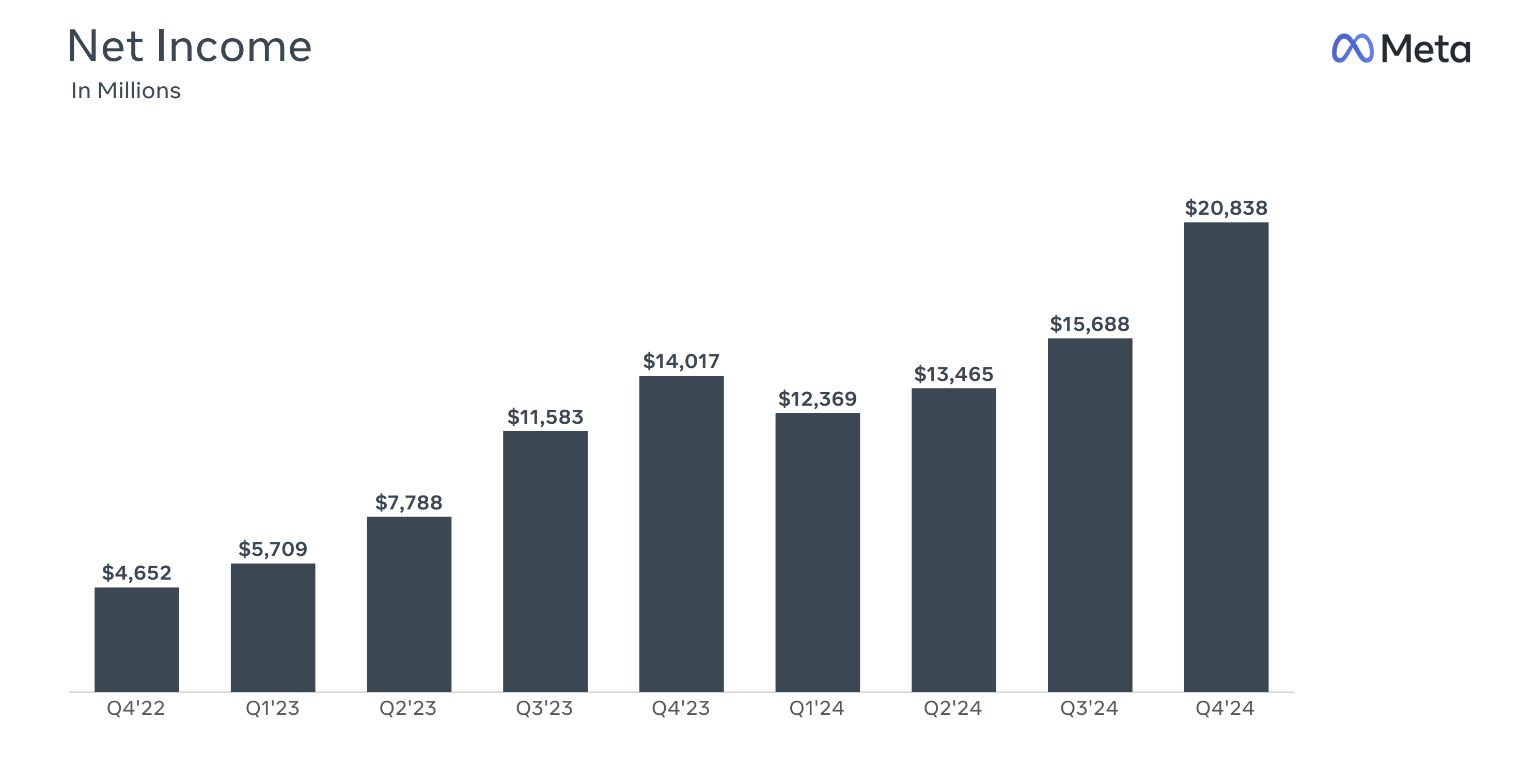

Let’s start with the basics. Meta earnings refer to the financial performance of Meta Platforms Inc., which includes revenue, profits, and other financial metrics reported on a quarterly or annual basis. These earnings are like a report card for the company, showing how well it’s doing in terms of generating income and managing expenses.

For instance, Meta’s earnings reports often highlight its revenue from advertising, which makes up the bulk of its income. In fact, ads account for around 98% of Meta’s total revenue. That’s a pretty impressive stat, right? But it’s not just about ads. Meta also generates revenue from its family of apps, including Facebook, Instagram, and WhatsApp.

Now, here’s the kicker: Meta’s earnings aren’t just about the money. They also provide insights into the company’s growth strategies, user engagement, and future plans. So, when you’re analyzing Meta earnings, you’re not just looking at numbers; you’re looking at the bigger picture.

Why Are Meta Earnings Important?

Meta earnings are more than just a set of numbers. They’re a reflection of the company’s health and potential. For investors, these earnings reports are like treasure maps, guiding them on where to put their money. For businesses, they offer valuable insights into how Meta is shaping the digital advertising landscape.

Here’s a quick breakdown of why Meta earnings matter:

- They show how well Meta is performing financially.

- They highlight key growth areas and future opportunities.

- They provide insights into user behavior and market trends.

- They influence stock prices and investor confidence.

In short, Meta earnings are a crucial indicator of the company’s success and its impact on the global economy. So, whether you’re an investor, a business owner, or just a curious individual, understanding Meta earnings can give you a competitive edge.

Read also:Lee Sehee Husband The Inside Story Of Love Life And Success

How Are Meta Earnings Calculated?

Now that we know what Meta earnings are, let’s talk about how they’re calculated. Meta earnings are typically calculated using a combination of revenue, expenses, and profits. The company reports its earnings on a quarterly basis, providing detailed insights into its financial performance.

Here’s a simplified breakdown of the process:

- Revenue: Meta calculates its revenue by adding up all the money it makes from ads, apps, and other services.

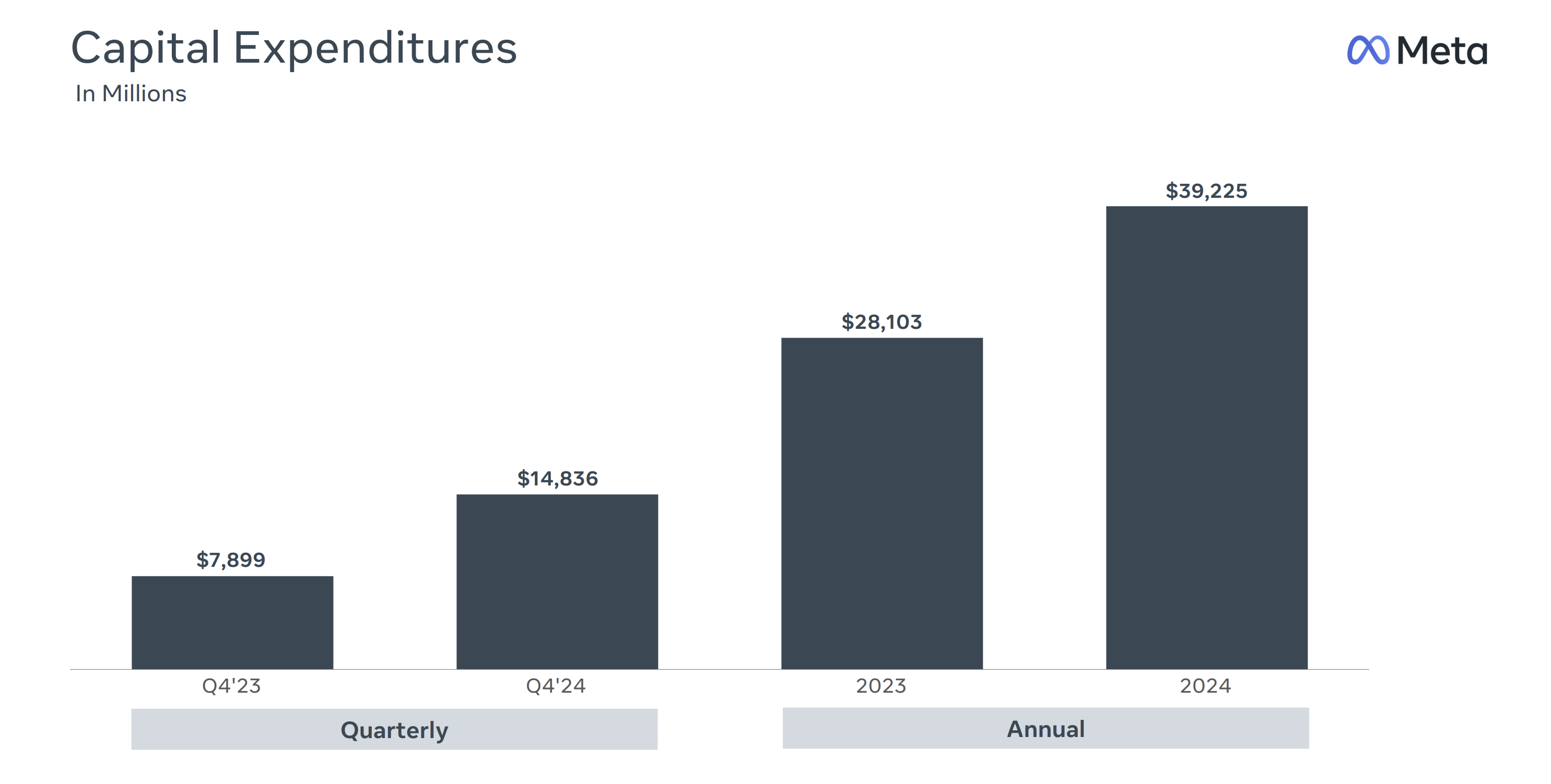

- Expenses: The company then subtracts its operating expenses, such as salaries, research and development, and marketing costs.

- Profit: The final step is to calculate the profit by subtracting expenses from revenue. This gives investors a clear picture of how much money Meta is actually making.

But here’s the thing: Meta’s earnings aren’t just about crunching numbers. The company also considers external factors, such as market trends, competition, and regulatory changes, when calculating its earnings. This holistic approach ensures that investors get a comprehensive view of Meta’s financial health.

Key Metrics to Watch in Meta Earnings Reports

When analyzing Meta earnings reports, there are a few key metrics you should keep an eye on:

- Revenue Growth: This metric shows how much Meta’s revenue has increased over time.

- Operating Expenses: This metric highlights the company’s spending on operations and development.

- Profit Margins: This metric measures how much profit Meta makes for every dollar of revenue.

- User Engagement: This metric tracks how users interact with Meta’s platforms, such as Facebook and Instagram.

By monitoring these metrics, you can get a better understanding of Meta’s financial performance and its potential for future growth.

Meta Earnings vs. Other Tech Giants

Now, let’s compare Meta earnings to those of other tech giants, such as Google, Amazon, and Apple. This comparison can give you a clearer picture of where Meta stands in the tech industry.

For starters, Meta’s revenue is heavily reliant on advertising, which sets it apart from companies like Amazon, which generate revenue from e-commerce. On the other hand, Meta’s user engagement metrics are comparable to those of Google and Apple, which also rely on digital platforms to drive revenue.

Here’s a quick comparison:

- Meta: 98% of revenue from ads, strong user engagement.

- Google: 80% of revenue from ads, strong search engine dominance.

- Amazon: Majority of revenue from e-commerce, growing cloud services.

- Apple: Majority of revenue from hardware sales, growing services segment.

As you can see, each company has its own unique strengths and challenges. Meta’s focus on advertising and user engagement gives it a competitive edge in the digital advertising space, but it also makes it vulnerable to changes in consumer behavior and regulatory scrutiny.

What Sets Meta Apart?

So, what makes Meta stand out in the crowded tech landscape? For one, its family of apps—Facebook, Instagram, and WhatsApp—gives it a massive user base and unparalleled reach. Additionally, Meta’s focus on innovation, particularly in areas like virtual reality and artificial intelligence, positions it as a leader in the tech industry.

But here’s the real kicker: Meta’s ability to adapt to changing market conditions and consumer preferences is what sets it apart from the competition. Whether it’s pivoting to e-commerce during the pandemic or investing in the metaverse, Meta has shown a knack for staying ahead of the curve.

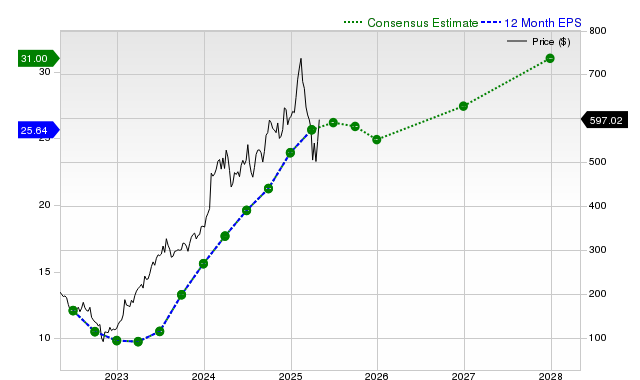

The Impact of Meta Earnings on the Stock Market

Meta earnings have a significant impact on the stock market. When the company reports strong earnings, its stock price tends to rise, attracting more investors. Conversely, weak earnings reports can lead to a drop in stock prices, causing concern among investors.

Here’s how it works: Investors use Meta earnings reports to gauge the company’s financial health and growth potential. If the earnings are better than expected, it boosts investor confidence, driving up the stock price. On the other hand, if the earnings fall short of expectations, it can lead to a sell-off, causing the stock price to drop.

But here’s the thing: Meta’s impact on the stock market goes beyond just its own stock price. As one of the largest tech companies in the world, Meta’s performance can influence the broader tech sector and even the overall market. So, when Meta earnings are strong, it’s good news for everyone.

How Investors Use Meta Earnings Reports

Investors use Meta earnings reports in a variety of ways:

- Assessing Financial Health: Investors analyze revenue, profits, and expenses to evaluate Meta’s financial health.

- Identifying Growth Opportunities: Investors look for areas where Meta is investing in future growth, such as the metaverse and AI.

- Predicting Future Performance: Investors use historical data and trends to predict how Meta will perform in the future.

By using these strategies, investors can make informed decisions about whether to buy, hold, or sell Meta stock.

Challenges Facing Meta Earnings

While Meta has been enjoying a period of strong financial performance, it’s not without its challenges. From regulatory scrutiny to changing consumer behavior, Meta faces a number of obstacles that could impact its earnings in the future.

Here are some of the key challenges:

- Regulatory Scrutiny: Meta is under increasing pressure from regulators around the world, particularly in areas like data privacy and antitrust.

- Changing Consumer Behavior: As users shift their attention to new platforms and trends, Meta must adapt to stay relevant.

- Competition: With companies like TikTok and Snapchat gaining ground, Meta faces stiff competition in the social media space.

Despite these challenges, Meta remains committed to innovation and growth, investing heavily in areas like AI and the metaverse to ensure its long-term success.

How Meta is Addressing These Challenges

Meta is taking a proactive approach to addressing these challenges:

- Investing in Innovation: Meta is pouring resources into developing new technologies, such as virtual reality and AI, to stay ahead of the competition.

- Enhancing User Privacy: Meta is working to improve its data privacy practices to address regulatory concerns and build trust with users.

- Expanding into New Markets: Meta is exploring new revenue streams, such as e-commerce and subscription services, to diversify its income sources.

By taking these steps, Meta aims to mitigate the risks associated with its earnings and ensure sustained growth in the future.

The Future of Meta Earnings

So, what does the future hold for Meta earnings? While it’s impossible to predict with certainty, the trends suggest that Meta is well-positioned for continued success. With its massive user base, innovative technologies, and diverse revenue streams, Meta has the potential to deliver strong financial performance for years to come.

Here are a few key trends to watch:

- The Metaverse: Meta’s investment in the metaverse could open up new revenue opportunities in areas like virtual events and digital commerce.

- AI and Machine Learning: Meta’s focus on AI and machine learning could enhance user engagement and drive ad revenue growth.

- Global Expansion: Meta’s efforts to expand into emerging markets could provide a significant boost to its earnings.

Of course, there are risks and uncertainties ahead, but Meta’s track record of innovation and adaptability gives reason for optimism.

Final Thoughts on Meta Earnings

In conclusion, Meta earnings are a crucial indicator of the company’s financial health and growth potential. Whether you’re an investor, a business owner, or just a curious individual, understanding Meta earnings can give you valuable insights into the world of tech and finance.

So, what’s next? If you’re interested in learning more about Meta earnings, be sure to check out the company’s quarterly earnings reports and stay up-to-date with the latest news and trends. And don’t forget to share your thoughts and questions in the comments below. We’d love to hear from you!

Table of Contents

Here’s a quick guide to the key sections of this article:

- What Are Meta Earnings?

- Why Are Meta Earnings Important?

- How Are Meta Earnings Calculated?

- Key Metrics to Watch in Meta Earnings Reports

- Meta Earnings vs. Other Tech Giants

- The Impact of Meta Earnings on the Stock Market

- Challenges Facing Meta Earnings

- The Future of Meta Earnings

- Final Thoughts on Meta Earnings

Thanks for reading, and we hope you found this article informative and engaging. Remember, the world of tech and finance is always changing, so stay curious and keep learning!

Article Recommendations