IBM Stock: Your Ultimate Guide To Investing In The Tech Giant

Alright folks, let's talk about IBM stock. If you're even remotely into the world of tech and finance, IBM is a name you’ve probably heard a million times. But what exactly does it mean for your investment portfolio? Is it worth jumping on the bandwagon? And what’s the deal with this tech behemoth anyway? Let’s dive in and break it all down for ya.

IBM stock has been around longer than most people realize. It's not just some random company that popped up overnight. This is a legacy brand with a history that stretches back over a century. So, if you're thinking about dipping your toes into the stock market, IBM could be one of those solid options that bring stability and growth potential to your portfolio.

Now, before we get into the nitty-gritty, let me tell you something. Investing in stocks is not just about picking a company and hoping for the best. It's about understanding the market, analyzing trends, and making informed decisions. And that's exactly what we're going to do here. By the time you finish reading this, you'll have a clearer picture of whether IBM stock is right for you.

Read also:Who Is The Skinniest Man In The World The Untold Story Behind Extreme Thinness

What Exactly is IBM Stock?

IBM stock represents ownership in one of the oldest and most respected technology companies in the world. When you buy shares of IBM, you're essentially buying a tiny piece of this massive corporation. But it's not just about owning a stock certificate; it's about being part of a company that's been at the forefront of innovation for over 100 years.

IBM, or International Business Machines Corporation, started way back in 1911. It began as a company that manufactured punch card tabulating machines and has since evolved into a global leader in technology and consulting services. Today, IBM is heavily involved in areas like cloud computing, artificial intelligence, and cybersecurity.

So, why should you care about IBM stock? Well, for starters, it's a company that's consistently adapting to the changing tech landscape. Whether it's through acquisitions, partnerships, or internal R&D, IBM is always looking for ways to stay ahead of the curve. And that's exactly the kind of company you want in your portfolio.

Why Invest in IBM Stock?

Let's talk about the reasons why IBM stock might be a good investment for you. First and foremost, it's a stable company with a long history of success. Unlike some of the newer tech companies that are still figuring things out, IBM has been around for over a century and has weathered countless economic storms.

Another reason to consider IBM stock is its dividend policy. IBM has a history of paying dividends, which means that even if the stock price doesn't move much, you can still earn money just by holding the stock. And let's be honest, who doesn't love a little extra cash flow?

Lastly, IBM is heavily invested in cutting-edge technologies like AI and cloud computing. These are areas that are only going to grow in the coming years, and being part of a company that's leading the charge can be a smart move for your investment portfolio.

Read also:Allison Eastwood A Rising Star In Hollywoods Spotlight

The History of IBM: A Legacy of Innovation

IBM has a fascinating history that's worth exploring. The company started out as the Computing-Tabulating-Recording Company (CTR) back in 1911. It wasn't until 1924 that it officially became International Business Machines Corporation. Over the years, IBM has undergone numerous transformations, always staying ahead of the technological curve.

In the 1950s, IBM introduced its first computer, the IBM 701. This was a game-changer for the company and marked the beginning of its dominance in the tech industry. Throughout the decades, IBM continued to innovate, introducing products like the IBM PC in the 1980s and the Watson AI system in the 2010s.

Today, IBM is a global leader in technology and consulting services. It has operations in over 170 countries and employs hundreds of thousands of people worldwide. Its commitment to innovation and customer service has made it one of the most respected companies in the world.

IBM's Key Business Segments

IBM operates in several key business segments, each of which plays a crucial role in its overall success. Let's take a look at some of the most important ones:

- Cloud & Cognitive Software: This segment includes IBM's cloud computing services and its AI offerings like Watson. It's one of the fastest-growing areas of the company and represents a significant portion of its revenue.

- Global Business Services: This segment focuses on consulting and professional services. IBM helps businesses transform their operations through technology and innovation.

- Global Technology Services: This segment provides IT infrastructure services and support to businesses around the world. It's a crucial part of IBM's revenue stream.

- Systems: This segment includes IBM's hardware offerings, such as servers and storage systems. It's a smaller but still important part of the company's operations.

By diversifying its business segments, IBM ensures that it can weather economic downturns and adapt to changing market conditions. This makes it a more stable investment compared to companies that rely on a single product or service.

IBM Stock Performance: The Numbers Don't Lie

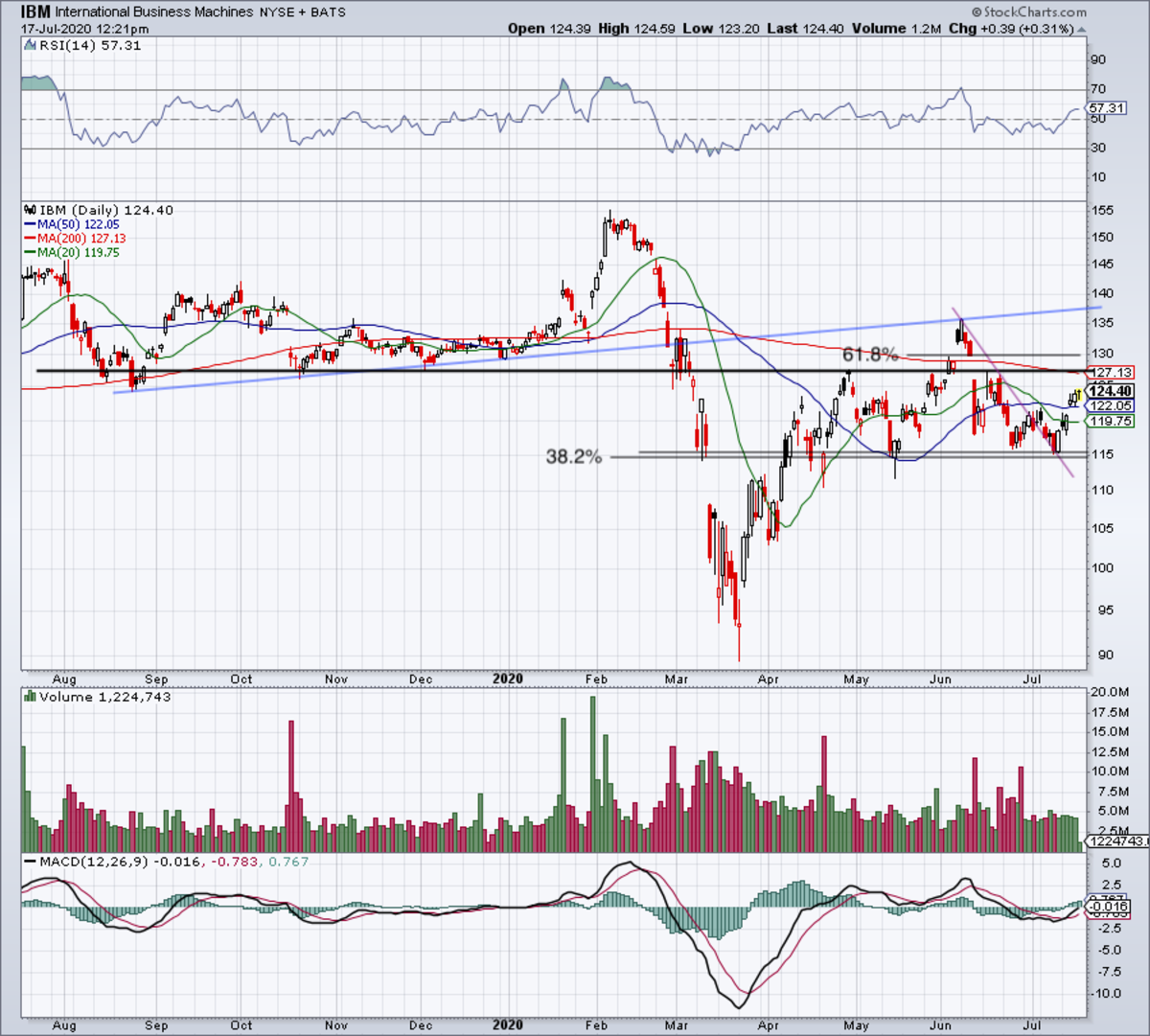

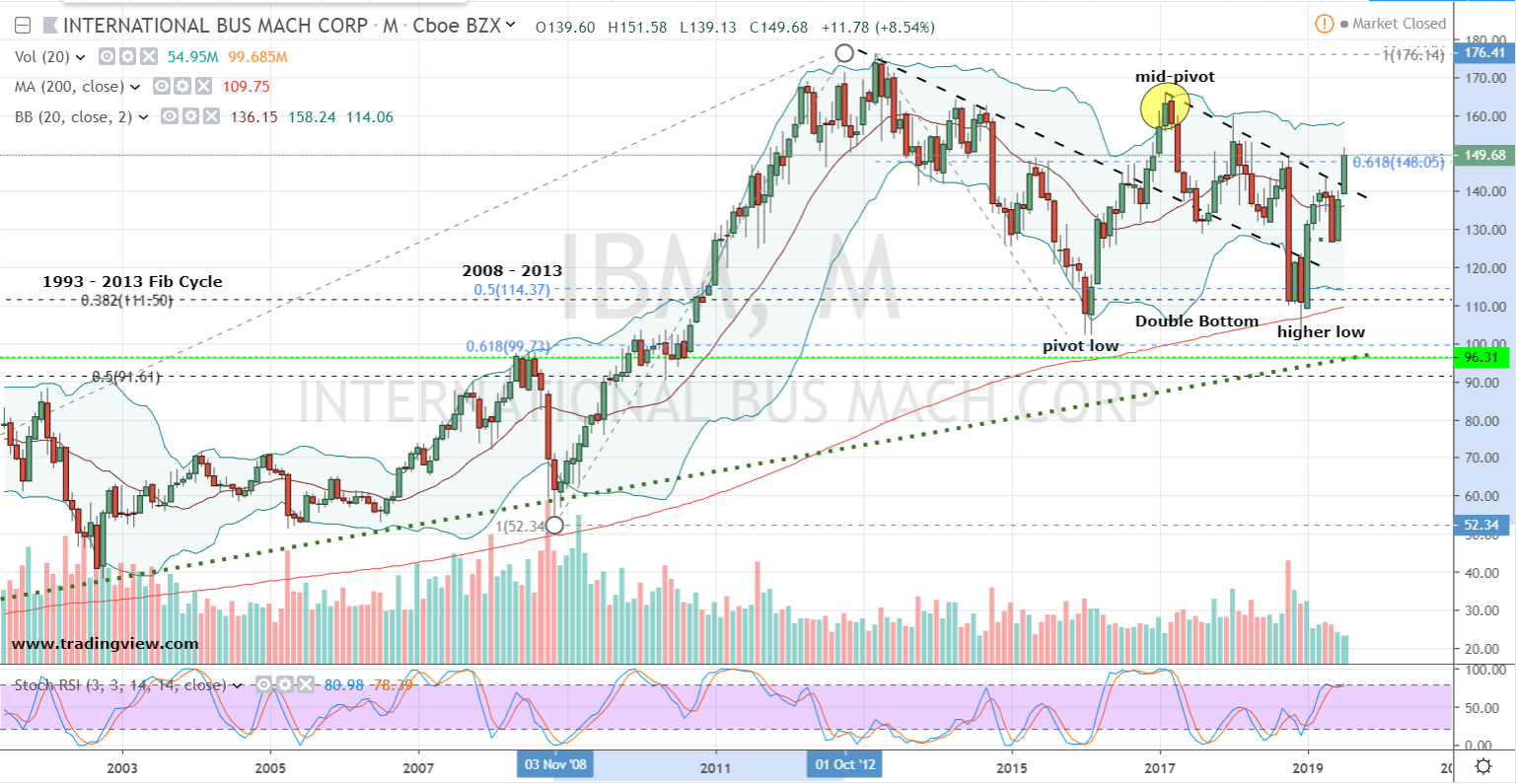

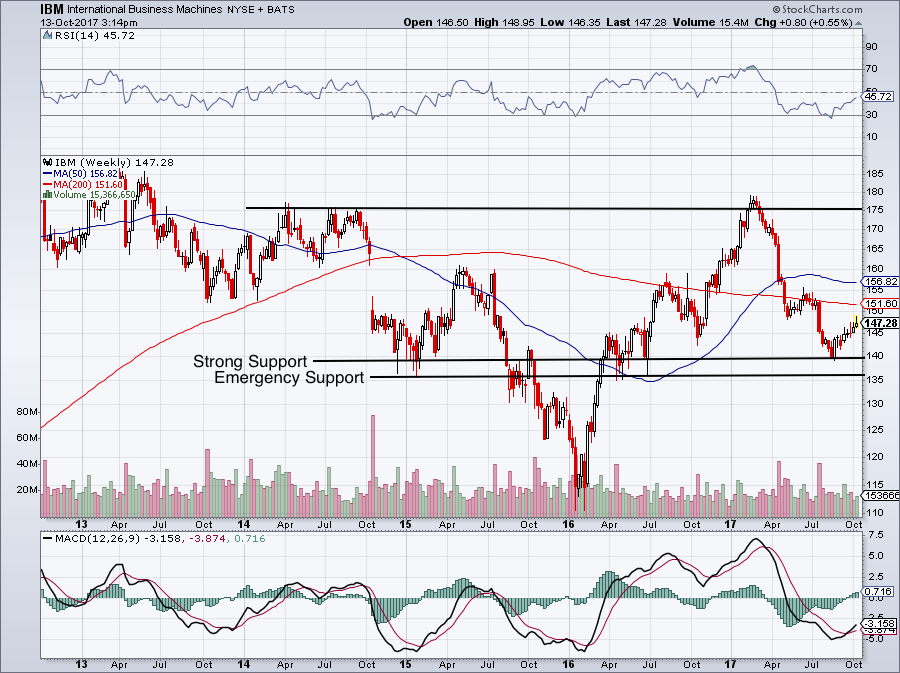

When it comes to IBM stock, the numbers tell an interesting story. Over the past few years, IBM's stock performance has been relatively stable, with some ups and downs along the way. In 2021, IBM stock saw a significant increase in value, driven by its strong performance in the cloud and AI sectors.

As of 2023, IBM stock is trading at around $130 per share. This represents a solid return on investment for those who bought in earlier. However, it's important to note that stock prices can be volatile, and past performance is no guarantee of future results.

One of the key factors driving IBM's stock performance is its focus on innovation. The company continues to invest heavily in R&D, ensuring that it stays ahead of the competition. This has led to new product launches and partnerships that have boosted its stock price.

Factors Affecting IBM Stock Price

There are several factors that can affect IBM stock price. Let's take a look at some of the most important ones:

- Economic Conditions: Like any company, IBM is affected by broader economic trends. Recessions or economic downturns can impact its revenue and stock price.

- Technological Innovation: IBM's ability to innovate and stay ahead of the curve is crucial to its success. New product launches or breakthroughs in AI and cloud computing can drive its stock price up.

- Competition: IBM operates in a highly competitive industry. Companies like Amazon, Microsoft, and Google are all vying for market share in the cloud and AI sectors.

- Regulatory Environment: Changes in government regulations can also impact IBM's operations and stock price. For example, new data privacy laws could affect its cloud computing business.

Understanding these factors can help you make more informed decisions about investing in IBM stock.

IBM's Dividend Policy: A Key Benefit for Investors

One of the biggest draws of IBM stock is its dividend policy. IBM has a long history of paying dividends, which means that even if the stock price doesn't move much, you can still earn money just by holding the stock. As of 2023, IBM pays a quarterly dividend of $1.40 per share, which translates to an annual dividend yield of around 4.2%.

This dividend policy is particularly attractive to income-focused investors who are looking for a steady stream of cash flow. It also provides a sense of stability and reliability, which is important in the often-volatile world of stock investing.

IBM's commitment to paying dividends is a testament to its financial strength and stability. It shows that the company is confident in its ability to generate consistent revenue and profits, even in uncertain economic times.

IBM's Financial Health: A Look at the Numbers

IBM's financial health is another important factor to consider when evaluating its stock. Let's take a look at some of the key financial metrics:

- Revenue: IBM reported revenue of $57.4 billion in 2022, a slight increase from the previous year. This indicates that the company is still growing, albeit at a slower pace than some of its competitors.

- Profit Margin: IBM's profit margin was around 10% in 2022, which is slightly lower than some of its peers. However, this is still a respectable number and indicates that the company is profitable.

- Debt Levels: IBM has a relatively high level of debt, which can be a concern for some investors. However, the company has been working to reduce its debt levels in recent years.

Overall, IBM's financial health is solid, but it's important to keep an eye on these metrics as you evaluate its stock.

IBM's Future Outlook: What's on the Horizon?

Looking ahead, IBM has a bright future ahead of it. The company is heavily invested in cutting-edge technologies like AI and cloud computing, which are only going to grow in importance in the coming years. IBM's focus on innovation and customer service positions it well to take advantage of these trends.

Additionally, IBM is exploring new areas like quantum computing, which could revolutionize the tech industry in the future. While it's still early days for quantum computing, IBM is one of the leaders in this space and has already made significant progress.

Of course, there are challenges ahead for IBM. The company faces stiff competition from other tech giants like Amazon, Microsoft, and Google. It also needs to continue to innovate and adapt to changing market conditions. But with its long history of success and commitment to innovation, IBM is well-positioned to face these challenges head-on.

How to Invest in IBM Stock

So, how do you go about investing in IBM stock? The process is relatively straightforward:

- Choose a Broker: The first step is to choose a reputable online broker. There are many options available, so do your research and choose one that fits your needs.

- Open an Account: Once you've chosen a broker, open an account and fund it with the amount you want to invest.

- Place Your Order: Once your account is funded, you can place an order to buy IBM stock. Be sure to do your research and understand the risks involved before making any investment decisions.

Investing in IBM stock is a smart move for those who are looking for a stable, long-term investment. With its focus on innovation and customer service, IBM is a company that's built to last.

Conclusion: Is IBM Stock Right for You?

Alright folks, let's wrap this up. IBM stock is a solid investment option for those who are looking for stability and growth potential. With its long history of success, commitment to innovation, and strong financial health, IBM is a company that's built to last.

Of course, investing in stocks always carries some level of risk. It's important to do your research and understand the factors that can impact IBM's stock price before making any investment decisions. But if you're looking for a company that's at the forefront of technology and innovation, IBM is definitely worth considering.

So, what are you waiting for? Take the plunge and see if IBM stock is the right fit for your investment portfolio. And don't forget to share this article with your friends and leave a comment below. Let's keep the conversation going!

Table of Contents

- IBM's History: A Legacy of Innovation

- IBM's Key Business Segments

- IBM Stock Performance: The Numbers Don't Lie

- Factors Affecting IBM Stock Price

- IBM's Dividend Policy: A Key Benefit for Investors

- IBM's Financial Health: A Look at the Numbers

- IBM's Future Outlook: What's on the Horizon?

- How to Invest in IBM Stock

Article Recommendations