2024 Tax Brackets: What You Need To Know About Your Money

Hey there, tax season might not be the most exciting time of year, but it's definitely a big deal when it comes to your wallet. The 2024 tax brackets are here, and they’re shaping up to be a game-changer for many taxpayers. Whether you're a seasoned pro at filing or this is your first rodeo, understanding these brackets is key to maximizing your savings and avoiding costly mistakes. So, grab a coffee, get comfy, and let's dive into the nitty-gritty of how the 2024 tax brackets could impact you.

Taxes can feel overwhelming, especially with all the jargon and numbers flying around. But don’t sweat it! We’re breaking down everything you need to know about the 2024 tax brackets in a way that’s easy to digest. From how much you’ll owe to potential deductions, we’ve got you covered.

Before we jump into the details, let’s set the stage. The IRS adjusts tax brackets annually to account for inflation, which means your tax bill might look a little different this year compared to last year. Ready to take control of your finances? Let’s go!

Read also:Who Is Whitney Cummings The Multitalented Comedian Writer And Tv Personality You Need To Know

Understanding the Basics of 2024 Tax Brackets

Alright, so what exactly are tax brackets? Think of them like different levels of income that get taxed at specific rates. The more you earn, the higher the tax rate you pay on that extra income. But here’s the cool part: it’s not like all your income gets taxed at the highest rate. Instead, only the portion of your income that falls within a certain bracket gets taxed at that rate. Make sense?

How Tax Brackets Work in 2024

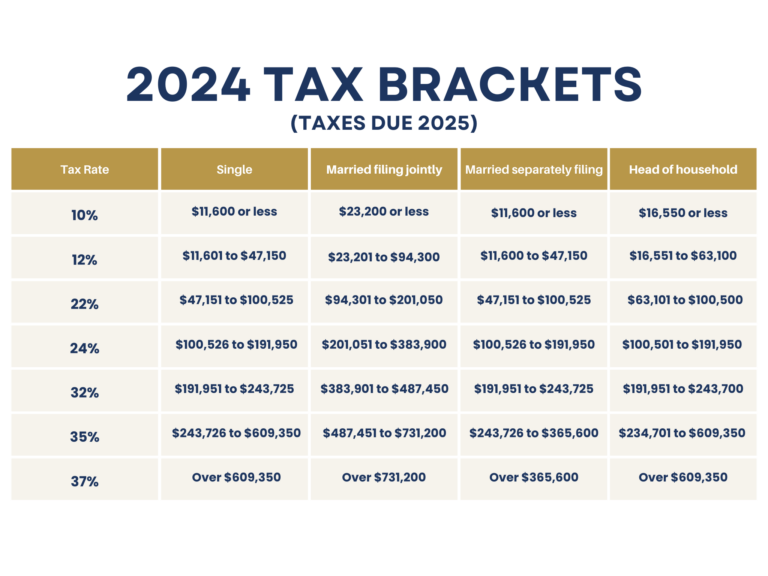

In 2024, the IRS has adjusted the brackets slightly to reflect inflation. Here’s a quick rundown of how it works:

- 10% bracket: For individuals earning up to $11,000

- 12% bracket: For earnings between $11,001 and $44,725

- 22% bracket: For income between $44,726 and $95,375

- 24% bracket: For income between $95,376 and $182,100

- 32% bracket: For income between $182,101 and $231,250

- 35% bracket: For income between $231,251 and $578,125

- 37% bracket: For income over $578,125

These rates apply to single filers, but if you’re married filing jointly, the numbers are a bit higher. More on that later!

Why the 2024 Tax Brackets Matter to You

Now, you might be thinking, “Why should I care about these numbers?” Well, here’s the thing: understanding your tax bracket can help you plan better financially. Knowing where you stand can guide decisions like whether to contribute more to retirement accounts or how much you might owe come April 15th.

What’s Changed Since Last Year?

Every year, the IRS tweaks the brackets to keep up with inflation. In 2024, you’ll notice that the thresholds are a bit higher than they were in 2023. That means more people might find themselves in a lower bracket, which is always a win!

How to Calculate Your Tax Bracket

Figuring out your tax bracket isn’t rocket science, but it does require a bit of math. Here’s a step-by-step guide:

Read also:Sandra Erome The Rising Star In Digital Content Creation

Step 1: Determine your filing status (single, married filing jointly, etc.).

Step 2: Add up your taxable income for the year.

Step 3: Match your income to the appropriate bracket based on your filing status.

For example, if you’re single and your taxable income is $50,000, you’d fall into the 22% bracket. But again, only the portion of your income above $44,725 would be taxed at that rate.

Common Mistakes to Avoid

When calculating your tax bracket, it’s easy to make mistakes. Here are a few to watch out for:

- Forgetting deductions or credits that can lower your taxable income

- Using the wrong filing status

- Not accounting for additional income sources, like side gigs or investments

Impact of 2024 Tax Brackets on Different Income Levels

Let’s talk about how these brackets affect folks at various income levels. Whether you’re just starting out or you’re a high earner, the 2024 tax brackets have something to say about your situation.

Low-Income Filers

If you’re on the lower end of the income spectrum, the good news is that the 10% and 12% brackets are pretty generous. This means you’ll keep more of your hard-earned cash. Plus, there are plenty of credits and deductions available to help reduce your tax burden even further.

Middle-Income Filers

For those in the middle, the 22% and 24% brackets are where you’ll likely land. While the rates are higher, there are still opportunities to save through smart planning. Consider maxing out retirement contributions or exploring education credits if applicable.

High-Income Filers

At the upper levels, things get a bit trickier. If you’re in the 32%, 35%, or 37% brackets, it’s crucial to work with a tax professional to ensure you’re optimizing every possible deduction and credit. Don’t forget about state taxes too—they can add up quickly!

Tax Planning Tips for 2024

Now that you know the brackets, let’s talk strategy. Here are some tips to help you make the most of the 2024 tax brackets:

- Contribute to retirement accounts like IRAs or 401(k)s to lower taxable income

- Take advantage of education credits if you’re paying for school

- Invest in tax-efficient vehicles like Roth accounts if eligible

- Consider bunching deductions in one year to exceed the standard deduction

Remember, every little bit helps when it comes to reducing your tax bill. Even small adjustments can add up to big savings over time.

When to Consult a Tax Pro

Not everyone needs a tax professional, but if you’re dealing with complex situations—like owning a business or having significant investments—it’s probably worth it. A good tax advisor can spot opportunities you might miss and help ensure you’re compliant with all the rules.

2024 Tax Brackets for Married Couples

Married couples filing jointly get a bit of a break when it comes to tax brackets. The thresholds are higher, which means more income can be taxed at lower rates. Here’s a quick look:

- 10% bracket: For couples earning up to $22,000

- 12% bracket: For earnings between $22,001 and $89,450

- 22% bracket: For income between $89,451 and $190,750

- 24% bracket: For income between $190,751 and $364,200

- 32% bracket: For income between $364,201 and $462,500

- 35% bracket: For income between $462,501 and $693,750

- 37% bracket: For income over $693,750

As you can see, the numbers are significantly higher, giving married couples more breathing room before they hit the higher brackets.

Head of Household Filers

If you’re a single parent or otherwise qualify as head of household, your brackets fall somewhere between single and married rates. Here’s what you’re looking at:

- 10% bracket: For income up to $16,450

- 12% bracket: For earnings between $16,451 and $54,100

- 22% bracket: For income between $54,101 and $132,850

- 24% bracket: For income between $132,851 and $204,100

- 32% bracket: For income between $204,101 and $231,250

- 35% bracket: For income between $231,251 and $578,125

- 37% bracket: For income over $578,125

It’s worth noting that head of household filers often have more deductions available to them, so be sure to explore those options.

Common Questions About 2024 Tax Brackets

Got questions? We’ve got answers. Here are some of the most frequently asked questions about the 2024 tax brackets:

Q: Will the brackets change again next year?

A: Probably. The IRS adjusts the brackets annually to account for inflation, so expect some tweaks in 2025 as well.

Q: Can I move to a lower bracket?

A: While you can’t technically move to a lower bracket, you can reduce your taxable income through deductions and credits, effectively lowering your overall tax rate.

Q: What happens if I go over my bracket limit?

A: Only the portion of your income above the limit gets taxed at the higher rate. Your other income is still taxed at the lower rates.

Final Thoughts: Preparing for Tax Season

Alright, we’ve covered a lot of ground here, but the bottom line is this: understanding the 2024 tax brackets is essential for anyone looking to manage their finances wisely. Whether you’re a rookie or a seasoned pro, knowing where you stand can help you make smarter decisions throughout the year.

So, what’s next? Take a few minutes to review your income and filing status. Look for opportunities to reduce your taxable income and consider consulting a tax professional if you’re unsure about anything. And hey, don’t forget to bookmark this article for future reference!

Got thoughts or questions? Drop a comment below, share this with your friends, or check out some of our other articles on personal finance. Until next time, stay sharp and keep those tax dollars working for you!

Table of Contents

- Understanding the Basics of 2024 Tax Brackets

- Why the 2024 Tax Brackets Matter to You

- How to Calculate Your Tax Bracket

- Impact of 2024 Tax Brackets on Different Income Levels

- Tax Planning Tips for 2024

- 2024 Tax Brackets for Married Couples

- Common Questions About 2024 Tax Brackets

- Final Thoughts: Preparing for Tax Season

Article Recommendations