Student Loan Repayment Rules Revealed: A Must-Read Guide For Every Borrower

Hey there, future debt warrior! Are you ready to dive into the nitty-gritty of student loan repayment rules? Whether you're fresh out of college or have been paying off loans for years, this guide has got your back. Student loan repayment rules can feel like a maze, but don’t worry—we’re breaking it all down for you so you can navigate it like a pro.

Let’s be real: student loans are a double-edged sword. On one hand, they open doors to education and opportunities; on the other, they can feel like an albatross around your neck. But hey, knowledge is power, and understanding the repayment rules can save you a ton of money and stress. In this guide, we’ll cover everything you need to know about repaying those loans without losing your mind.

So grab a coffee, get comfy, and let’s unravel the secrets of student loan repayment. By the end of this, you’ll be armed with the tools and insights to tackle your loans head-on. Let’s do this!

Read also:Funky Town Cartel Video The Ultimate Guide To The Phenomenon Everyones Talking About

Table of Contents

- Understanding Student Loan Repayment Rules

- Types of Student Loans and How They Work

- Standard Repayment Plans: The Basics

- Income-Driven Repayment Options: Tailored Plans

- Loan Consolidation: Simplify Your Payments

- Deferment and Forbearance: Breathing Room When You Need It

- Loan Forgiveness Programs: Your Ticket to Freedom

- Common Mistakes to Avoid in Repayment

- Tax Implications of Student Loan Repayment

- Final Thoughts and Next Steps

Understanding Student Loan Repayment Rules

Alright, let’s start with the basics. Student loan repayment rules are the guidelines that dictate how you pay back your loans. These rules vary depending on the type of loan you have, your financial situation, and even your career path. It’s not just about sending in a check every month; there are strategies and options that can make repayment easier and more manageable.

For starters, most federal student loans come with a standard 10-year repayment period. But did you know there are other plans that can extend that period or adjust your payments based on your income? Yep, it’s true! Understanding these options is key to making repayment work for you, not against you.

Why Knowing the Rules Matters

Knowing the rules can save you thousands of dollars in interest and fees. For example, did you know that some loans offer interest rate reductions if you set up auto-pay? Or that certain professions qualify for loan forgiveness programs? These are the kinds of details that can make a huge difference in your financial future.

Types of Student Loans and How They Work

Before we dive deeper into repayment rules, let’s talk about the different types of student loans. There are two main categories: federal loans and private loans. Each comes with its own set of rules and options for repayment.

Federal Loans: The Safe Bet

Federal student loans are issued by the government and typically offer more flexible repayment options. Some of the most common types include:

Read also:Joplin Tornado Article The Devastation And Resilience Unveiled

- Direct Subsidized Loans: These are based on financial need, and the government pays the interest while you’re in school.

- Direct Unsubsidized Loans: Available to all students, but you’re responsible for paying the interest from day one.

- PLUS Loans: These are for graduate students or parents of undergrads, and they require a credit check.

Federal loans also come with benefits like income-driven repayment plans and loan forgiveness programs, which we’ll cover later.

Private Loans: The Riskier Option

Private loans are issued by banks or other financial institutions. They often have higher interest rates and fewer repayment options than federal loans. Plus, they don’t qualify for federal benefits like loan forgiveness or deferment. However, they can be a good option if you’ve exhausted your federal loan options and still need more funding.

Standard Repayment Plans: The Basics

Most borrowers start with a standard repayment plan, which means paying a fixed amount each month for 10 years. It’s simple and straightforward, but it might not be the best option for everyone. Here’s why:

While the standard plan has the lowest total interest cost, it can be tough on borrowers who are just starting their careers or have low incomes. If you’re struggling to make ends meet, there are other plans that might be a better fit.

Pros and Cons of Standard Repayment

Let’s break it down:

- Pros: Lower total interest paid, predictable monthly payments.

- Cons: Higher monthly payments, may not be affordable for everyone.

Income-Driven Repayment Options: Tailored Plans

If the standard plan isn’t working for you, consider an income-driven repayment plan. These plans adjust your monthly payments based on your income and family size, making them more manageable for borrowers with lower incomes.

Types of Income-Driven Plans

There are several income-driven repayment options available:

- Income-Based Repayment (IBR): Caps payments at 10-15% of your discretionary income.

- Income-Contingent Repayment (ICR): Caps payments at 20% of your discretionary income or the amount you’d pay on a 12-year repayment plan.

- Pay As You Earn (PAYE): Caps payments at 10% of your discretionary income.

- Revised Pay As You Earn (REPAYE): Similar to PAYE, but available to all borrowers regardless of when they took out their loans.

These plans can significantly reduce your monthly payments, but keep in mind that they may extend the life of your loan and increase the total amount of interest you pay.

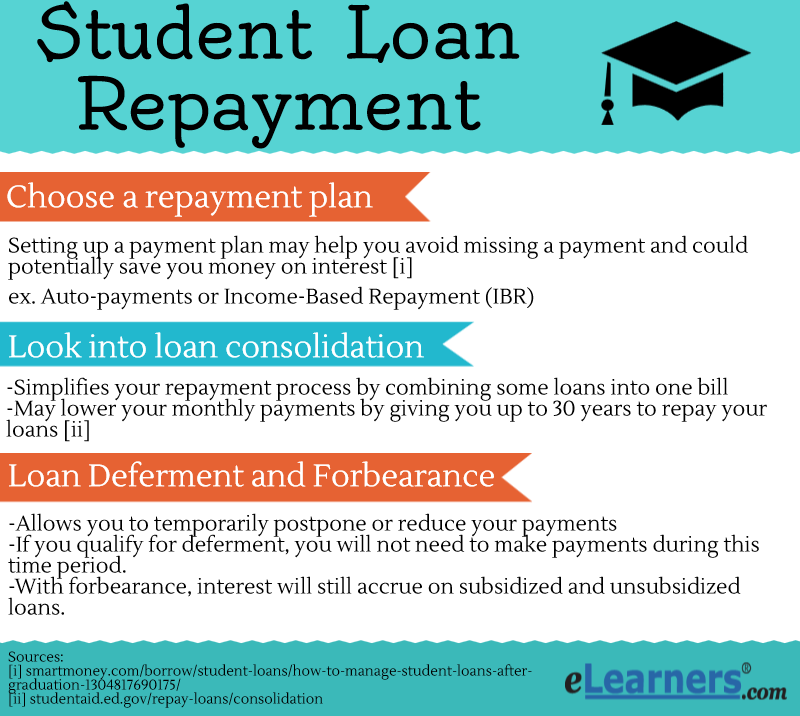

Loan Consolidation: Simplify Your Payments

If you have multiple loans, consolidating them into a single loan can simplify your repayment process. Loan consolidation combines all your loans into one, giving you a single monthly payment and a single interest rate.

Benefits of Loan Consolidation

Here’s why you might want to consider consolidating your loans:

- One monthly payment instead of many.

- Access to different repayment plans.

- Potential for a lower interest rate (if you consolidate private loans).

However, consolidation isn’t always the best option. It can reset the clock on loan forgiveness programs, and you may lose certain benefits associated with your original loans.

Deferment and Forbearance: Breathing Room When You Need It

Life happens, and sometimes you need a break from your student loan payments. That’s where deferment and forbearance come in. Both options allow you to temporarily pause your payments, but they work differently.

Deferment

Deferment is typically available for situations like returning to school, serving in the military, or experiencing economic hardship. During deferment, interest on subsidized loans is paid by the government, but interest on unsubsidized loans continues to accrue.

Forbearance

Forbearance is more flexible than deferment and can be used for a wider range of situations. However, interest continues to accrue on all types of loans during forbearance, so it’s important to use this option wisely.

Loan Forgiveness Programs: Your Ticket to Freedom

Loan forgiveness programs are a game-changer for many borrowers. These programs forgive all or part of your loans after a certain number of qualifying payments. Here are a few of the most popular programs:

- Public Service Loan Forgiveness (PSLF): Forgives loans after 120 qualifying payments for borrowers working in public service jobs.

- Teacher Loan Forgiveness: Forgives up to $17,500 for teachers working in low-income schools.

- Nurse Corps Loan Repayment Program: Forgives loans for nurses working in underserved areas.

These programs can save you thousands of dollars, but they come with specific requirements and restrictions. Make sure you understand the rules before enrolling.

Common Mistakes to Avoid in Repayment

Even the savviest borrowers can make mistakes when it comes to student loan repayment. Here are a few pitfalls to watch out for:

- Not exploring all repayment options.

- Making late payments or missing payments altogether.

- Not taking advantage of interest rate reductions or discounts.

- Consolidating loans without understanding the consequences.

By avoiding these mistakes, you can save yourself a lot of headaches—and money—in the long run.

Tax Implications of Student Loan Repayment

Did you know that student loan interest may be tax-deductible? That’s right! If you meet certain criteria, you can deduct up to $2,500 of the interest you paid on your student loans each year. This can reduce your taxable income and lower your tax bill.

Eligibility for the Deduction

To qualify for the student loan interest deduction, you must:

- Be legally obligated to pay the interest on a qualified student loan.

- Have filed as single, head of household, or married filing jointly.

- Not have been claimed as a dependent on someone else’s tax return.

It’s a small perk, but every little bit helps when you’re paying off student loans.

Final Thoughts and Next Steps

And there you have it—a comprehensive guide to student loan repayment rules. Whether you’re just starting your repayment journey or looking for ways to optimize your existing plan, the key is to stay informed and proactive. Remember, knowledge is power, and the more you know about your options, the better equipped you’ll be to tackle your loans.

So here’s what you can do next:

- Review your current repayment plan and see if there are better options available.

- Explore loan forgiveness programs if you qualify.

- Set up auto-pay to take advantage of interest rate reductions.

- Stay on top of your payments to avoid penalties and fees.

And don’t forget to share this guide with your friends and family. The more people who understand student loan repayment rules, the better off we all are. Let’s conquer those loans together! Now go forth and slay those student loans like the debt warrior you are! Cheers!

Article Recommendations