Colorado 1099-G: A Deep Dive Into Tax Forms, Benefits, And Everything You Need To Know

Let’s face it, folks—tax season can be a real headache, but if you’re in Colorado and dealing with Form 1099-G, you’re not alone. Whether you’re self-employed, a contractor, or just trying to wrap your head around government payments, this form is a crucial piece of the puzzle. But what exactly is a Colorado 1099-G? Why does it matter? And how does it affect your taxes? Grab a cup of coffee, because we’re about to break it all down for you.

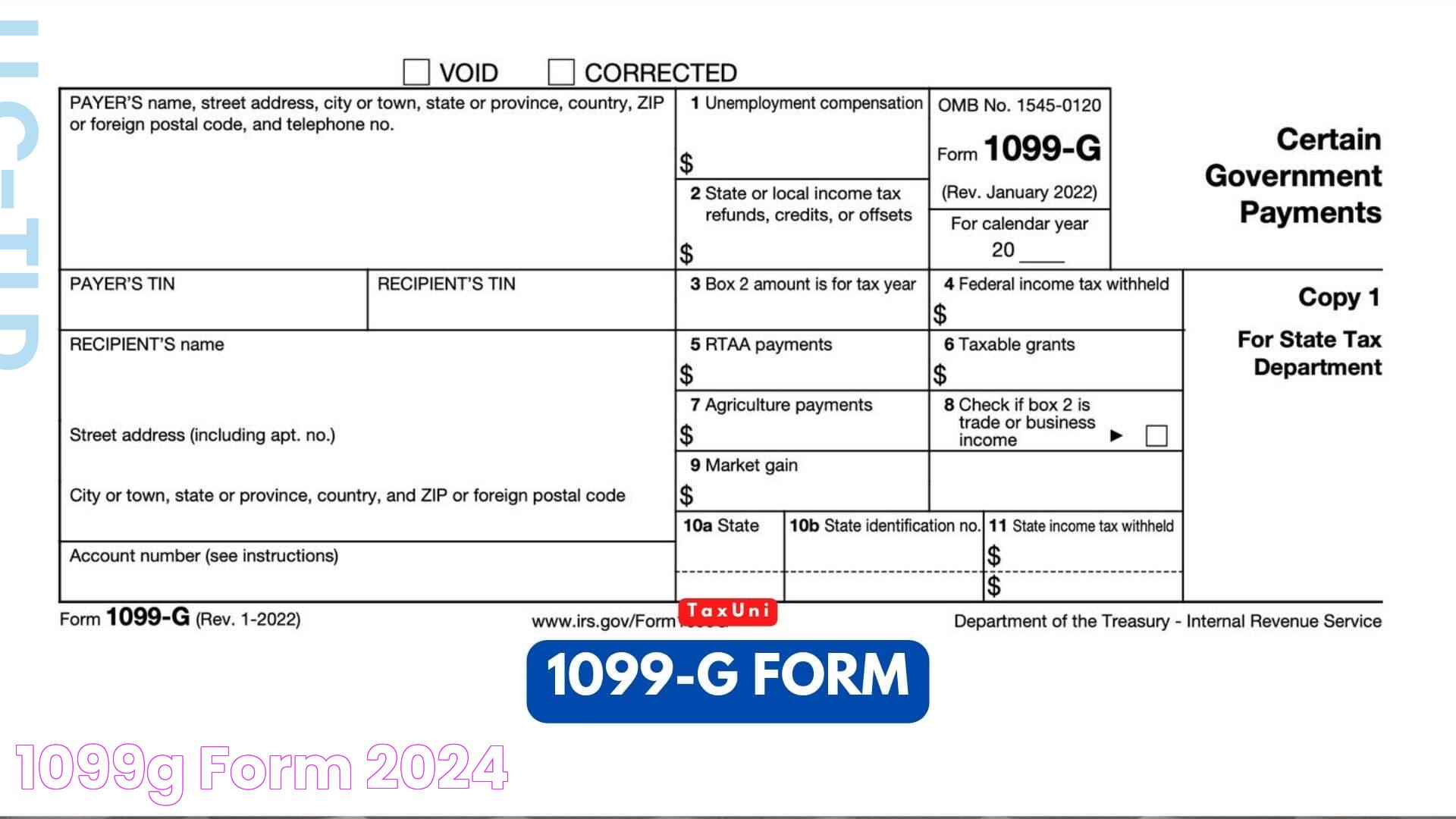

First things first, the 1099-G is a tax form that reports certain types of income you might have received from state or local governments. This could include unemployment compensation, tax refunds, or even payments from government programs. If you’ve ever gotten a check from Uncle Sam or the Colorado Department of Revenue, this form is your ticket to making sure everything gets reported correctly on your tax return.

Now, before we dive headfirst into the nitty-gritty, let’s get one thing straight: taxes don’t have to be scary. With the right information and a bit of guidance, you can navigate the 1099-G like a pro. So buckle up, because we’re about to take you through everything you need to know about this form and how it impacts your financial life.

Read also:Who Is The Skinniest Man In The World The Untold Story Behind Extreme Thinness

What Exactly is a Colorado 1099-G Form?

Alright, let’s start with the basics. The Colorado 1099-G form is essentially a document that the state sends to individuals who have received certain types of payments from the government. These payments could range from unemployment benefits to tax refunds. It’s basically the government’s way of saying, “Hey, here’s what you got from us last year—make sure you report it!”

Here’s the deal: if you’ve received any of the following, you’ll likely get a 1099-G in the mail:

- Unemployment compensation

- State tax refunds

- Government grants or awards

- Other specified payments from state or local governments

But here’s the kicker—just because you got a 1099-G doesn’t mean all of that money is taxable. Some of it might be exempt, depending on your situation. That’s why it’s super important to read the form carefully and consult with a tax professional if you’re unsure.

Why Should You Care About the Colorado 1099-G?

Let’s be real, folks—ignoring your tax forms is like ignoring a giant red flag waving in your face. The Colorado 1099-G isn’t just a piece of paper; it’s a crucial part of your tax filing process. If you fail to report the information on this form, you could end up owing more taxes—or worse, facing penalties from the IRS or the Colorado Department of Revenue.

Think about it: when the government sends you money, they expect you to account for it. Whether it’s unemployment benefits or a tax refund, these payments are part of your total income for the year. By ignoring the 1099-G, you’re essentially leaving money on the table—or worse, opening yourself up to unnecessary headaches down the road.

Key Details You Need to Know

So, what exactly should you be looking for on your 1099-G? Here are a few key details that you’ll want to pay attention to:

Read also:Blue Bloods New Season 15 Everything You Need To Know About The Latest Drama

- **Box 1:** This shows any unemployment compensation you received during the year.

- **Box 3:** This reports any state tax refunds you got, which might need to be included in your federal taxable income.

- **Box 4:** This shows any federal income tax withheld from your unemployment compensation.

Pro tip: double-check these numbers against your own records. Mistakes happen, and the last thing you want is to file your taxes with incorrect information.

Who Receives the Colorado 1099-G?

Not everyone gets a 1099-G, so don’t panic if you haven’t received one. Generally, this form is sent to individuals who:

- Received unemployment benefits during the year.

- Got a state tax refund or credit.

- Received certain types of government payments, like grants or awards.

If none of these apply to you, chances are you won’t see a 1099-G in your mailbox. But if you do, make sure you hang onto it—you’ll need it when you file your taxes.

What Happens If You Don’t Receive Your 1099-G?

Sometimes, stuff gets lost in the mail. If you think you should have received a 1099-G but haven’t, don’t freak out. The first step is to contact the entity that issued the form, whether it’s the Colorado Department of Revenue or another government agency. They can usually resend the form or provide you with the necessary information.

And here’s a little secret: even if you don’t have the physical form, you can still file your taxes. Just use your own records to report the income or payments you received. Just make sure everything matches up, and you’ll be good to go.

How to File Your Taxes with a Colorado 1099-G

Now that you’ve got your 1099-G in hand, it’s time to tackle the big question: how do you actually use it to file your taxes? The process isn’t as scary as it sounds, but it does require a bit of attention to detail.

First, you’ll need to enter the information from your 1099-G onto your federal tax return. Depending on what type of income is reported, you might need to include it on different lines of your Form 1040. For example:

- Unemployment compensation goes on Line 8 of Form 1040.

- State tax refunds go on Line 21, if they’re taxable.

Once you’ve entered everything, double-check your work to make sure all the numbers match up. And if you’re feeling overwhelmed, don’t hesitate to reach out to a tax professional or use tax software to help guide you through the process.

Tips for Filing Accurately

Here are a few quick tips to help you file your taxes accurately with a 1099-G:

- Keep detailed records of all income and payments you receive throughout the year.

- Compare the information on your 1099-G to your own records before filing.

- Use tax software or consult with a professional if you’re unsure about anything.

Remember, accuracy is key when it comes to taxes. A small mistake can lead to big problems, so take your time and make sure everything is correct.

Common Misconceptions About the Colorado 1099-G

There’s a lot of confusion out there about the 1099-G, so let’s clear up a few common misconceptions:

- **Misconception #1:** All income on the 1099-G is taxable.

Reality: Not necessarily! Some payments, like certain government grants, might be exempt from taxes. - **Misconception #2:** You don’t need the 1099-G to file your taxes.

Reality: While you can technically file without it, having the form makes the process much easier and more accurate. - **Misconception #3:** The 1099-G is only for contractors.

Reality: Nope! It’s for anyone who receives certain types of government payments.

By understanding these misconceptions, you’ll be better equipped to navigate the world of tax forms and avoid unnecessary headaches.

How to Avoid Common Mistakes

When it comes to taxes, mistakes happen. But with a little bit of effort, you can avoid some of the most common pitfalls:

- Double-check all numbers on your 1099-G against your own records.

- Make sure you’re entering the information on the correct lines of your tax return.

- Consult with a tax professional if you’re unsure about anything.

Trust me, taking these extra steps can save you a ton of trouble in the long run.

Colorado 1099-G and Your Finances: What You Need to Know

Let’s talk about the bigger picture here. The Colorado 1099-G isn’t just about filing your taxes—it’s also about managing your overall finances. Understanding how this form fits into your financial life can help you make smarter decisions throughout the year.

For example, if you know you’re going to receive unemployment benefits, you can plan ahead and adjust your budget accordingly. Or, if you’re expecting a state tax refund, you can factor that into your savings or investment strategy. The key is to stay informed and proactive.

Strategies for Financial Success

Here are a few strategies to help you make the most of your Colorado 1099-G:

- Use tax software to simplify the filing process.

- Consult with a financial advisor to create a long-term plan.

- Stay organized by keeping all your tax documents in one place.

By taking these steps, you’ll be well on your way to mastering your finances and making the most of the 1099-G.

Conclusion: Take Control of Your Taxes

Alright, folks, we’ve covered a lot of ground here. From understanding what the Colorado 1099-G is to navigating the filing process, you’re now armed with the knowledge you need to tackle tax season like a pro.

Remember, the key to success is staying informed and organized. Keep your records up-to-date, double-check your work, and don’t hesitate to reach out for help if you need it. And most importantly, don’t let the stress of taxes get the better of you. With the right mindset and tools, you can conquer anything that comes your way.

So, what’s next? Take action! File your taxes, share this article with your friends, and let’s make tax season a little less scary for everyone. You’ve got this!

Table of Contents

Article Recommendations