Why UPS Stock Is A Smart Investment In Today's Market

So here's the deal, if you're looking to dive into the world of investing and you're curious about UPS stock, you've come to the right place. The global supply chain has been all over the place lately, and UPS has been a major player in keeping things moving. This isn't just about boxes and deliveries; it's about a company that's been around for over a century, adapting to change and delivering value to its shareholders. Let's talk about why UPS stock could be the next big thing in your portfolio.

You might be thinking, "Why should I care about UPS stock when there are so many other options out there?" Well, my friend, UPS isn't just another logistics company. They've got a massive global network, cutting-edge technology, and a customer base that spans industries. Whether you're into e-commerce, healthcare, or even retail, UPS plays a role in keeping those businesses running smoothly. And in today's fast-paced world, that's a big deal.

Now, before we dive deeper, let's be clear: this isn't just a sales pitch. We're going to break down the ins and outs of UPS stock, talk about its strengths, weaknesses, and why it could be a smart investment for your future. So grab a coffee, sit back, and let's explore why UPS stock might be worth your time and money.

Read also:Will Meghan Markle Break Royal Tradition At Her Wedding

Understanding the UPS Stock Landscape

First things first, let's talk about what makes UPS stock so unique. UPS has been in the logistics game since 1907, and they've seen their fair share of ups and downs. But what sets them apart is their ability to pivot and innovate. In recent years, they've invested heavily in technology, sustainability, and global expansion. These moves aren't just flashy—they're strategic. They position UPS as a leader in an industry that's only going to grow.

Key Factors Driving UPS Stock Growth

So, what's driving the growth of UPS stock? Let's break it down:

- E-commerce Boom: With more people shopping online than ever before, UPS has been a key player in fulfilling those orders. From small businesses to global giants, UPS handles it all.

- Global Expansion: UPS isn't just about the U.S. market. They've got a massive presence in Europe, Asia, and beyond. This global reach gives them a competitive edge.

- Sustainability Initiatives: In an era where environmental impact matters, UPS is investing in electric vehicles and alternative fuels. This not only helps the planet but also cuts costs in the long run.

- Technological Innovation: From drones to AI-driven logistics, UPS is all about staying ahead of the curve. This tech focus helps them operate more efficiently and deliver better results for their customers.

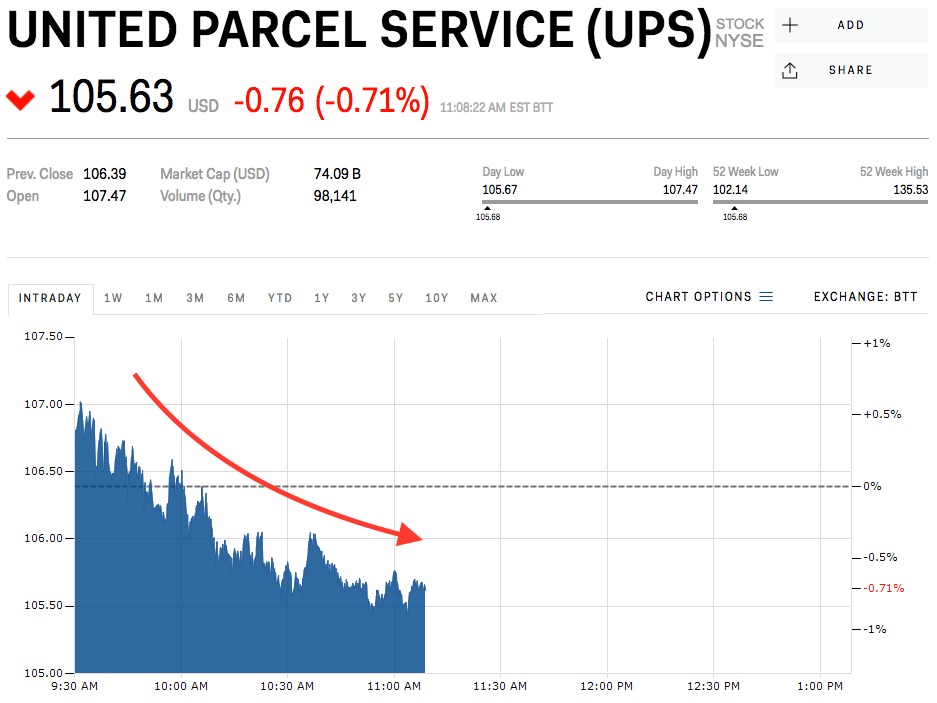

The Financial Performance of UPS Stock

Now, let's get into the numbers. Over the past few years, UPS stock has shown some impressive growth. Despite the challenges of the pandemic, they managed to deliver strong financial results. In 2022 alone, UPS reported a revenue of $93 billion, with a net income of $5.7 billion. These numbers don't lie—they show a company that's not only surviving but thriving in a competitive market.

What the Analysts Are Saying

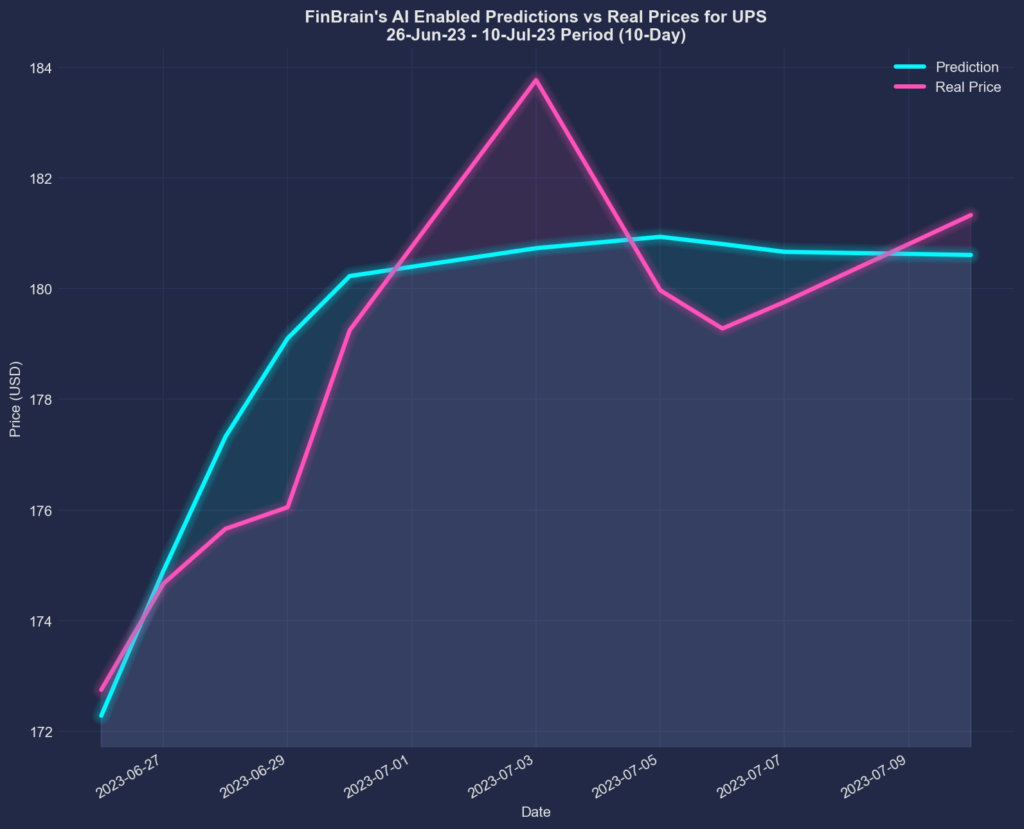

Analysts from top firms like Morgan Stanley and J.P. Morgan have been bullish on UPS stock. They cite the company's strong cash flow, solid dividend history, and strategic investments as reasons to believe in its long-term potential. Sure, there are risks, but the upside seems to outweigh the downsides for many investors.

UPS Stock vs. Competitors

When you're considering UPS stock, it's important to look at how they stack up against the competition. FedEx and DHL are the big names in the logistics space, but UPS has a few tricks up its sleeve. Their focus on customer service, technology, and sustainability gives them an edge. Plus, their long-standing relationships with major retailers like Amazon and Walmart don't hurt.

Market Share and Competitive Advantage

UPS holds a significant share of the global logistics market, and they're not planning to give it up anytime soon. Their competitive advantage lies in their ability to adapt to changing market conditions. Whether it's navigating supply chain disruptions or embracing new technologies, UPS is always one step ahead.

Read also:Lady Louise Windsor Growing Up In The Spotlight

Investing in UPS Stock: Risks and Rewards

Like any investment, UPS stock comes with its own set of risks and rewards. On the reward side, you've got a company with a proven track record, strong financials, and a commitment to innovation. But on the risk side, you've got factors like economic downturns, regulatory challenges, and increasing competition. It's important to weigh these factors before diving in.

How to Mitigate Risks

So, how do you mitigate the risks of investing in UPS stock? Diversification is key. Don't put all your eggs in one basket. Spread your investments across different sectors and asset classes. Additionally, keep an eye on market trends and be ready to adjust your strategy as needed.

Future Outlook for UPS Stock

Looking ahead, the future of UPS stock seems bright. With e-commerce continuing to grow, global trade expanding, and technology advancing at a rapid pace, UPS is well-positioned to capitalize on these trends. They've already made significant investments in areas like automation and sustainability, and they're not slowing down anytime soon.

Trends to Watch

Here are a few trends to keep an eye on:

- Automation: As more companies adopt automation, UPS is investing in technology to streamline their operations.

- Sustainability: With increasing pressure to reduce carbon footprints, UPS's focus on green initiatives will likely pay off in the long run.

- Global Trade: As trade barriers come down and new markets open up, UPS will be there to take advantage of the opportunities.

Why UPS Stock is a YMYL Investment

For those unfamiliar with the term, YMYL stands for "Your Money or Your Life." These are investments that have a direct impact on people's livelihoods and financial well-being. UPS stock fits squarely into this category. As a major player in the logistics industry, UPS affects millions of businesses and consumers worldwide. Investing in UPS stock isn't just about making money—it's about supporting a company that plays a crucial role in the global economy.

Trust and Authority in the Logistics Space

UPS has built a reputation for reliability and innovation over the years. Their commitment to quality service and cutting-edge technology has earned them the trust of customers and investors alike. This trust and authority are key factors in why UPS stock is a smart investment choice.

Expertise and Insights on UPS Stock

When it comes to investing, expertise matters. At the heart of UPS's success is a team of experts who know the logistics industry inside and out. From their leadership team to their engineers and analysts, UPS is packed with talent. This expertise translates into smart decisions and strong financial performance, making UPS stock a solid choice for investors.

Real-World Examples of UPS Stock Success

Take, for example, UPS's recent investments in electric vehicles. This move not only positions them as leaders in sustainability but also helps them cut costs in the long run. Or consider their acquisition of logistics companies in emerging markets. These strategic moves show a company that's not just reacting to change but proactively shaping the future of the industry.

Conclusion: Is UPS Stock Right for You?

In conclusion, UPS stock is a strong contender in the world of investments. With its solid financials, strategic investments, and commitment to innovation, UPS is a company that's built to last. But remember, investing is personal. What works for one person might not work for another. Take the time to research, understand the risks, and make an informed decision.

So, what's next? If you're interested in learning more about UPS stock, I encourage you to do your own research. Check out financial reports, analyst opinions, and market trends. And don't forget to share your thoughts in the comments below. Are you already invested in UPS stock? What do you think about their future? Let's keep the conversation going!

Table of Contents

- Understanding the UPS Stock Landscape

- Key Factors Driving UPS Stock Growth

- The Financial Performance of UPS Stock

- What the Analysts Are Saying

- UPS Stock vs. Competitors

- Market Share and Competitive Advantage

- Investing in UPS Stock: Risks and Rewards

- How to Mitigate Risks

- Future Outlook for UPS Stock

- Trends to Watch

- Why UPS Stock is a YMYL Investment

- Trust and Authority in the Logistics Space

- Expertise and Insights on UPS Stock

- Real-World Examples of UPS Stock Success

- Conclusion: Is UPS Stock Right for You?

That's a wrap, folks! Thanks for joining me on this journey through the world of UPS stock. Remember, investing is a marathon, not a sprint. Do your research, stay informed, and make smart decisions. Happy investing!

Article Recommendations