Why Insurance Matters More Than You Think In 2023

Sometimes life throws curveballs we don't see coming. Whether it's a car accident, unexpected medical emergency, or damage to your home, these situations can hit hard. That's where insurance comes in. Insurance isn't just some boring financial product; it's your safety net when things go sideways. Think of it like an invisible superhero standing guard over your assets, health, and peace of mind. Without proper coverage, one bad day could turn into a financial nightmare. So yeah, insurance might not be the sexiest topic, but it's definitely one worth paying attention to.

Now, I know what you're thinking—insurance sounds complicated and expensive. But here's the deal: understanding insurance doesn't have to feel like solving a math equation. In this article, we'll break it down in a way that makes sense, so you can make smarter decisions about protecting yourself and your loved ones. We're talking real-world examples, expert advice, and actionable tips to help you navigate the world of insurance without getting lost in jargon.

Before we dive deep, let's address the elephant in the room. Insurance is one of those "Your Money or Your Life" (YMYL) topics that matter big time. Why? Because the right coverage can literally save you from financial ruin. Whether you're buying your first car, starting a family, or planning for retirement, insurance plays a crucial role in safeguarding your future. So buckle up, because we're about to demystify the world of insurance in a way that actually makes sense.

Read also:When Mike Teevee From Willy Wonka Hit The Jeopardy Stage

Understanding the Basics of Insurance

Let's start with the fundamentals. At its core, insurance is all about managing risk. When you purchase an insurance policy, you're essentially paying a company to take on some of your potential financial risks. This could be anything from covering medical expenses to repairing your car after an accident. The idea is simple: you pay a premium, and in return, the insurance company promises to cover certain costs if something bad happens. Think of it like a backup plan for life's unexpected moments.

There are different types of insurance out there, each designed to protect specific aspects of your life. For instance, health insurance covers medical expenses, auto insurance protects you in case of car accidents, and homeowners insurance safeguards your property. The key is finding the right mix of coverage that fits your needs and budget. And don't worry—we'll break down the most common types of insurance later in this article.

Why Do We Need Insurance?

Here's the thing: life is unpredictable. No matter how careful you are, accidents happen, and unexpected events can pop up out of nowhere. Without insurance, even a minor incident could lead to significant financial strain. For example, a single trip to the emergency room could cost thousands of dollars. Multiply that by multiple visits, surgeries, or hospital stays, and you're looking at a mountain of debt. Insurance helps mitigate these risks by spreading them across a large group of people, making it more affordable for everyone involved.

Another important point: insurance isn't just about protecting your wallet. It also gives you peace of mind. Knowing that you're covered in case of an emergency allows you to focus on what truly matters—your health, family, and well-being. Plus, having the right insurance can save you time and hassle in the long run. Instead of dealing with complicated legal or financial issues, you can let your insurance provider handle the heavy lifting.

The Different Types of Insurance You Should Know

Now that we've covered the basics, let's talk about the different types of insurance available. Each type serves a unique purpose and addresses specific risks. Understanding these options will help you choose the right coverage for your situation. Here's a quick rundown of the most common types:

- Health Insurance: Covers medical expenses, including doctor visits, hospital stays, surgeries, and prescription medications.

- Auto Insurance: Protects you in case of car accidents, theft, or damage to your vehicle.

- Homeowners Insurance: Safeguards your home and belongings against fire, theft, natural disasters, and other covered events.

- Renter's Insurance: Similar to homeowners insurance but designed for people who rent their living space.

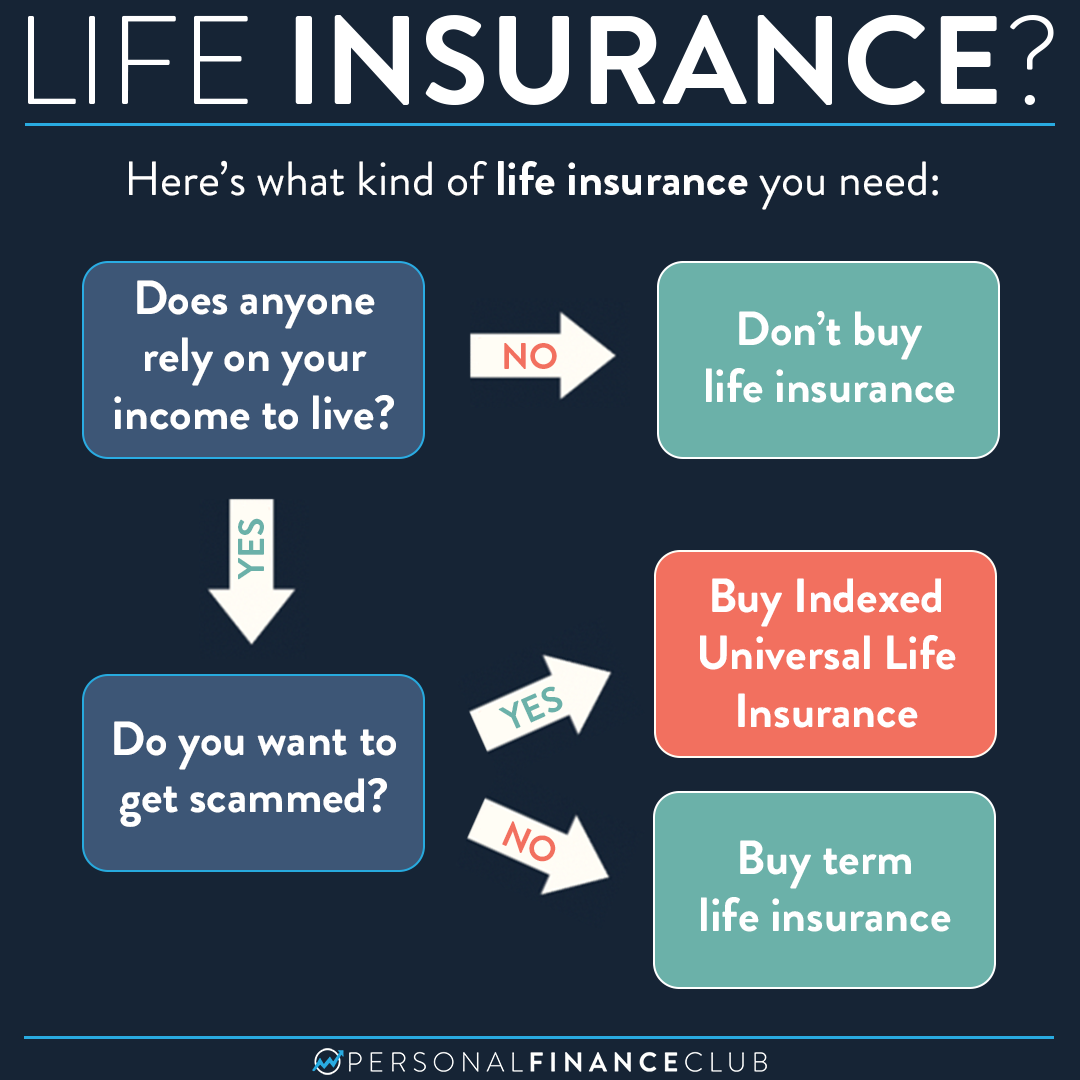

- Life Insurance: Provides financial support to your beneficiaries in the event of your death.

- Disability Insurance: Replaces a portion of your income if you become unable to work due to injury or illness.

These are just a few examples, but there are many other types of insurance depending on your lifestyle and needs. For instance, business owners may need liability insurance, and travelers might benefit from travel insurance. The key is assessing your risks and choosing coverage that aligns with your circumstances.

Read also:Miranda Lamberts Heartwarming Gift To Animal Shelters Nationwide

Breaking Down the Costs of Insurance

One of the biggest concerns people have about insurance is cost. Let's face it—no one likes spending money on something they hope they'll never need. But here's the reality: the cost of insurance is generally much lower than the potential expenses you'd face without it. Most policies require you to pay a premium, which is a regular fee (usually monthly or annually) that keeps your coverage active. Some policies may also include deductibles, which is the amount you pay out-of-pocket before your insurance kicks in.

Factors like your age, location, credit score, and claims history can all affect your insurance premiums. For example, younger drivers typically pay more for auto insurance because they're statistically more likely to get into accidents. Similarly, living in an area prone to natural disasters may increase your homeowners insurance costs. The good news is that many insurance companies offer discounts for things like safe driving, bundling multiple policies, or maintaining a good credit score.

How to Choose the Right Insurance Policy

With so many options available, choosing the right insurance policy can feel overwhelming. But don't panic—we've got you covered. Here are a few tips to help you make an informed decision:

- Assess your risks: Start by identifying the areas of your life that need protection. Are you a homeowner? Do you have dependents? Do you drive frequently? These factors will help determine which types of insurance are most important for you.

- Shop around: Don't settle for the first quote you receive. Get multiple quotes from different insurance providers to compare prices and coverage options.

- Read the fine print: Make sure you understand what's covered and what's not. Pay attention to exclusions, limits, and any conditions that might affect your coverage.

- Ask questions: If something isn't clear, don't hesitate to ask your insurance agent for clarification. They're there to help you make the best decision.

Remember, the goal is to find a balance between cost and coverage. While it might be tempting to opt for the cheapest policy, skimping on coverage could leave you vulnerable in the long run. On the flip side, over-insuring yourself can waste money on protection you don't need. It's all about finding the sweet spot that works for your unique situation.

Common Mistakes to Avoid When Buying Insurance

Buying insurance isn't always straightforward, and there are a few common mistakes people make that can cost them in the long run. Here are a few to watch out for:

- Underinsuring: Choosing coverage limits that are too low can leave you exposed to significant financial risks.

- Overpaying: Failing to shop around or negotiate for better rates can result in paying more than necessary.

- Ignoring policy details: Not reading the fine print can lead to unpleasant surprises when you need to file a claim.

- Assuming one policy fits all: Different people have different needs, so a policy that works for your neighbor might not be right for you.

By avoiding these pitfalls, you can ensure that your insurance provides the protection you need without breaking the bank.

Insurance and Your Financial Health

Insurance isn't just about protecting your assets—it's also an integral part of your overall financial health. Think of it as a safety net that supports your financial goals and helps you weather unexpected storms. For example, having adequate life insurance can ensure your family's financial security in the event of your passing. Disability insurance can replace lost income if you're unable to work, allowing you to maintain your standard of living. And health insurance can prevent medical debt from derailing your financial plans.

When planning your finances, consider insurance as part of your overall strategy. It complements other financial tools like savings accounts, investments, and retirement plans by providing a layer of protection against unforeseen events. By prioritizing insurance, you're taking a proactive step toward securing your financial future.

Building a Comprehensive Insurance Plan

A comprehensive insurance plan is one that addresses all your key areas of risk. This typically includes a mix of health, auto, homeowners, life, and disability insurance, depending on your circumstances. Start by evaluating your current coverage and identifying any gaps. For instance, if you're a homeowner but don't have homeowners insurance, that's a major risk you need to address. Similarly, if you have dependents but no life insurance, you might want to consider adding that to your plan.

Once you've identified your needs, work with a trusted insurance professional to create a customized plan that fits your budget and lifestyle. Regularly review your coverage to ensure it still meets your needs as your circumstances change. Life events like marriage, having children, or buying a home can all impact your insurance requirements.

Insurance in the Digital Age

The rise of technology has transformed the insurance industry in many ways. Today, you can compare quotes, purchase policies, and file claims online with just a few clicks. Many insurance companies also offer mobile apps that make managing your coverage easier than ever. These digital tools allow you to access your policy information, pay premiums, and even upload photos of damages for claims processing—all from the palm of your hand.

Another exciting development is the use of data analytics and artificial intelligence in underwriting and risk assessment. Insurers can now offer more personalized coverage options based on your specific needs and behaviors. For example, some auto insurance companies use telematics devices to track your driving habits and adjust your premiums accordingly. This can lead to lower rates for safe drivers and more accurate risk assessments.

The Future of Insurance

Looking ahead, the future of insurance looks bright thanks to advancements in technology. Innovations like blockchain, IoT (Internet of Things), and AI are paving the way for more efficient, transparent, and personalized insurance solutions. For instance, blockchain technology can enhance security and streamline claims processing by creating immutable records of transactions. Meanwhile, IoT devices can provide real-time data on everything from home security to health metrics, enabling insurers to offer more tailored coverage options.

As these technologies continue to evolve, we can expect insurance to become even more accessible, affordable, and user-friendly. The key for consumers is staying informed and embracing these changes to maximize the benefits they offer.

Expert Advice on Maximizing Your Insurance Benefits

To get the most out of your insurance, it's important to understand how to use it effectively. Here are a few expert tips to help you maximize your coverage:

- Review your policy annually: Things change over time, so it's a good idea to review your coverage regularly to ensure it still meets your needs.

- Bundle policies: Many insurers offer discounts if you bundle multiple policies, such as auto and homeowners insurance.

- Take advantage of preventive services: Some health insurance plans cover preventive care services like screenings and vaccines at no additional cost.

- Stay informed: Keep up with changes in insurance laws and regulations that might impact your coverage.

By following these tips, you can make the most of your insurance and ensure it's working for you, not against you.

Building Trust in Your Insurance Provider

Trust is a crucial factor when choosing an insurance provider. After all, you're entrusting them with your financial security and peace of mind. To build trust, look for companies with strong reputations, positive customer reviews, and a proven track record of honoring claims. It's also helpful to choose a provider that offers excellent customer service and transparent communication.

Additionally, consider working with a licensed insurance agent who can guide you through the process and advocate on your behalf. They can help you navigate complex policies, answer your questions, and ensure you're getting the best coverage for your needs.

Final Thoughts: Why Insurance Matters

In conclusion, insurance is more than just a financial product—it's a vital tool for protecting your assets, health, and peace of mind. By understanding the basics, choosing the right coverage, and staying informed, you can build a solid foundation for your financial future. Remember, the right insurance can save you from financial ruin and give you the confidence to face life's uncertainties head-on.

So, take the time to evaluate your insurance needs and make informed decisions about your coverage. And don't forget to share this article with friends and family who might benefit from the information. Together, we can all become smarter, more confident consumers when it comes to insurance. Because at the end of the day, it's not just about protecting what you have—it's about securing what's most important to you.

Call to Action

Now it's your turn. Have you ever had an experience with insurance that changed your perspective

Article Recommendations