IBM Stock: A Comprehensive Guide For Savvy Investors

IBM Stock has been a cornerstone of the financial world for decades, and understanding its dynamics is crucial for anyone looking to make informed investment decisions. Whether you're a seasoned investor or just starting out, diving into IBM's stock performance can reveal valuable insights. From its historical significance to its current market position, this article will provide you with everything you need to know about IBM stock. So, grab a coffee, and let's break it down!

In today’s fast-paced financial landscape, having a clear understanding of IBM stock is like having a secret weapon in your investment arsenal. With its rich history and innovative approach, IBM continues to influence the tech and financial sectors. As we navigate through this article, we’ll explore how IBM’s stock fits into the broader market context and why it remains a popular choice for investors.

Whether you're trying to figure out if IBM stock is right for your portfolio or simply want to stay informed about one of the largest tech companies in the world, this guide is here to help. Let’s dive into the nitty-gritty of IBM stock and uncover what makes it such a compelling investment opportunity.

Read also:Mariah Carey Opens Up About Battling Bipolar Disorder For Nearly Two Decades

Understanding IBM Stock: A Beginner's Perspective

When it comes to IBM stock, it’s essential to start with the basics. IBM, short for International Business Machines Corporation, is not just another tech company—it’s a giant that has shaped the tech industry for over a century. Founded way back in 1911, IBM has evolved from a tabulating machine company to a global leader in technology and consulting services. And its stock? Well, that’s been a story of resilience, innovation, and adaptability.

IBM stock is traded on the New York Stock Exchange (NYSE) under the ticker symbol IBM. Over the years, its performance has been a reflection of the company’s ability to pivot and innovate. From mainframes to cloud computing, IBM has consistently found new ways to stay relevant in an ever-changing market. This adaptability is what makes IBM stock so intriguing to both novice and experienced investors.

Why IBM Stock Matters in the Modern Market

In the modern financial world, IBM stock holds a unique position. It’s not just about the numbers; it’s about the impact IBM has on the tech industry as a whole. The company’s focus on artificial intelligence, cloud computing, and quantum computing has positioned it as a leader in cutting-edge technologies. This strategic shift has kept IBM stock in the spotlight, even as the tech landscape continues to evolve rapidly.

For investors, IBM stock represents more than just a financial asset. It’s a testament to the company’s ability to innovate and thrive in a competitive environment. By investing in IBM stock, you're essentially betting on the future of technology and the company’s continued leadership in this space.

IBM Stock Performance: A Historical Overview

Looking back at IBM stock’s performance over the years provides valuable insights into its growth and challenges. From its early days as a leader in mainframe computers to its current focus on cloud and AI, IBM’s journey has been nothing short of remarkable. The stock has seen its fair share of ups and downs, but its ability to recover and innovate has been a constant.

Historically, IBM stock has been a favorite among institutional investors due to its steady dividend payments and consistent revenue growth. Even during economic downturns, IBM has managed to maintain its position as a reliable investment option. This stability is what makes IBM stock appealing to long-term investors who prioritize consistency over quick gains.

Read also:Billy Grahams Legacy A Daughters Reflection And A Life Welllived

Key Milestones in IBM Stock History

- 1960s: IBM dominates the mainframe market, driving stock prices to new heights.

- 1980s: The introduction of the IBM PC revolutionizes the personal computing industry.

- 2000s: IBM shifts focus to software and services, leading to a new era of growth.

- 2010s: Cloud computing becomes a major driver of revenue, boosting stock performance.

Current IBM Stock Trends: What’s Happening Now?

As of late, IBM stock has been showing some exciting trends that are worth exploring. The company’s pivot towards hybrid cloud and AI has been paying off, with revenue growth in these areas outpacing other segments. This strategic focus has helped IBM stock recover from a period of stagnation and regain its footing in the tech industry.

Investors are also keeping a close eye on IBM’s acquisition strategy, which has been instrumental in expanding its capabilities in key areas. The acquisition of Red Hat, for example, has positioned IBM as a leader in open-source technology and cloud solutions. These moves have not only strengthened IBM’s position but have also positively impacted its stock performance.

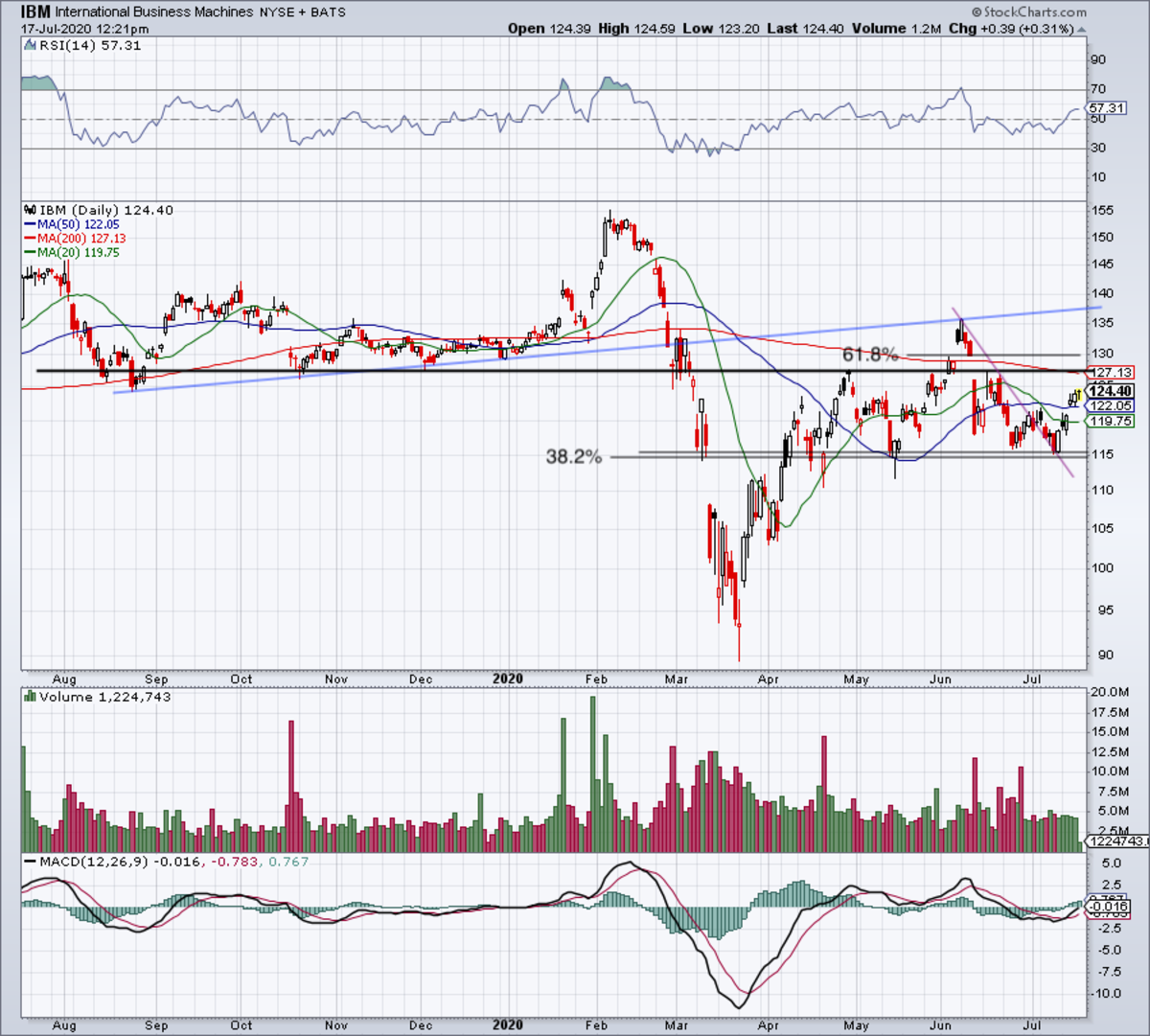

IBM Stock Price Analysis: Where Are We Now?

Currently, IBM stock is trading at a price that reflects its strong fundamentals and promising future. Analysts are optimistic about the company’s ability to continue growing its revenue streams and expanding its presence in the tech industry. This positive outlook is supported by IBM’s consistent earnings reports and its commitment to innovation.

For those considering investing in IBM stock, it’s important to look beyond the current price and focus on the long-term potential. The company’s strategic initiatives and market positioning suggest that IBM stock could be a smart addition to any diversified portfolio.

IBM Stock Dividends: A Key Attraction for Investors

One of the standout features of IBM stock is its generous dividend policy. For decades, IBM has been rewarding its shareholders with regular dividend payments, making it an attractive option for income-focused investors. The company’s commitment to maintaining and increasing its dividend has been a key factor in its appeal to long-term investors.

IBM stock’s dividend yield is competitive within the tech sector, providing investors with a steady stream of income while they wait for capital appreciation. This dual benefit makes IBM stock a popular choice for those looking to balance growth and income in their portfolios.

Understanding IBM Stock Dividend History

IBM’s dividend history is a testament to its financial stability and commitment to shareholder value. Over the years, the company has consistently increased its dividend payments, even during challenging economic times. This reliability has earned IBM a reputation as a dividend aristocrat, a title reserved for companies that have increased their dividends annually for at least 25 years.

For investors, understanding IBM stock’s dividend history is crucial in assessing its potential as a long-term investment. The company’s track record of dividend growth provides confidence that IBM will continue to reward its shareholders well into the future.

IBM Stock Market Analysis: Factors to Consider

When analyzing IBM stock, it’s important to consider a variety of factors that can impact its performance. From macroeconomic trends to industry-specific developments, understanding these influences can help investors make more informed decisions.

One of the key factors affecting IBM stock is the overall health of the tech industry. As a leader in cloud computing and AI, IBM’s success is closely tied to the growth of these sectors. Additionally, global economic conditions and geopolitical factors can also play a role in shaping IBM stock’s trajectory.

Key Drivers of IBM Stock Performance

- Growth in cloud computing and AI services

- Expansion through strategic acquisitions

- Innovation in quantum computing and other emerging technologies

IBM Stock vs Competitors: How Does It Stack Up?

Comparing IBM stock to its competitors can provide valuable insights into its strengths and weaknesses. In the tech industry, IBM faces stiff competition from companies like Microsoft, Amazon, and Google, all of whom are also heavily invested in cloud computing and AI.

While IBM may not have the same market capitalization as some of its rivals, it makes up for it with its unique offerings and strategic focus. The company’s expertise in hybrid cloud solutions and its commitment to open-source technology set it apart from the competition. These differentiators make IBM stock an attractive option for investors looking for a tech company with a distinct value proposition.

IBM Stock Competitive Edge

IBM’s competitive edge lies in its ability to innovate and adapt to changing market conditions. By focusing on emerging technologies and expanding its capabilities through acquisitions, IBM has positioned itself as a leader in the tech industry. This strategic approach has helped IBM stock maintain its relevance and appeal to investors.

IBM Stock Future Outlook: What’s Next?

Looking ahead, the future of IBM stock appears bright. With its focus on cutting-edge technologies like AI, cloud computing, and quantum computing, IBM is well-positioned to continue growing its revenue streams and expanding its market presence. The company’s commitment to innovation and its strong financial foundation provide a solid foundation for future success.

Investors should also keep an eye on IBM’s ongoing efforts to streamline its operations and enhance its profitability. These initiatives, combined with its strategic investments in key areas, suggest that IBM stock could deliver strong returns in the coming years.

Key Predictions for IBM Stock

- Continued growth in cloud and AI revenue

- Expansion into new markets and technologies

- Increased focus on sustainability and corporate responsibility

Investing in IBM Stock: Tips and Strategies

For those considering investing in IBM stock, there are several tips and strategies to keep in mind. First and foremost, it’s important to conduct thorough research and understand the company’s financials, strategic initiatives, and market position. This due diligence will help you make more informed investment decisions.

Additionally, consider your investment goals and risk tolerance when evaluating IBM stock. While it may not offer the same level of growth as some of its competitors, IBM’s stability and dividend policy make it an attractive option for long-term investors seeking consistent returns.

IBM Stock Investment Strategies

- Dollar-cost averaging to mitigate market volatility

- Reinvesting dividends to maximize returns

- Diversifying your portfolio to reduce risk

Conclusion: Why IBM Stock Should Be on Your Radar

In conclusion, IBM stock offers a compelling investment opportunity for those looking to participate in the growth of the tech industry. With its rich history, strong financials, and innovative approach, IBM continues to be a leader in the tech sector. Whether you're drawn to its dividend policy, its strategic focus on emerging technologies, or its long-term growth potential, IBM stock has something to offer every type of investor.

So, what are you waiting for? Dive into the world of IBM stock and discover why it’s a smart addition to your portfolio. Share your thoughts in the comments below, and don’t forget to check out our other articles for more insights into the world of investing. Your journey to financial success starts here!

Table of Contents

- Understanding IBM Stock: A Beginner's Perspective

- IBM Stock Performance: A Historical Overview

- Current IBM Stock Trends: What’s Happening Now?

- IBM Stock Dividends: A Key Attraction for Investors

- IBM Stock Market Analysis: Factors to Consider

- IBM Stock vs Competitors: How Does It Stack Up?

- IBM Stock Future Outlook: What’s Next?

- Investing in IBM Stock: Tips and Strategies

Article Recommendations