2024 Tax Brackets: A Straightforward Guide To Understanding Your Taxes This Year

Let’s face it, folks—tax time can be a real headache. But understanding the 2024 tax brackets is the first step toward mastering your finances. Whether you're a seasoned pro at filing or someone who dreads April 15 every year, knowing how tax brackets work can save you big bucks. So, buckle up because we’re diving deep into the world of taxes, and trust me, it’s not as scary as it sounds.

Now, I know what you’re thinking: “Why do I even need to know about tax brackets?” Well, here’s the deal. Tax brackets determine how much of your income gets taxed at different rates. It’s like a game of tiers where the more you earn, the higher the rate—but here’s the kicker: only the portion of your income that falls into each bracket gets taxed at that rate. Confusing? Don’t worry, we’ll break it down step by step.

Before we get into the nitty-gritty, let’s talk about why this matters. Understanding the 2024 tax brackets can help you plan better, save smarter, and avoid nasty surprises come tax season. Plus, it’s empowering to know exactly where your hard-earned cash is going. So, let’s roll up our sleeves and dive in!

Read also:Angelina Jolies New Love Story A Millionaire Philanthropist And Plans For The Altar

What Are Tax Brackets, Anyway?

Alrighty, let’s start with the basics. Tax brackets are essentially ranges of income that are taxed at specific rates. Think of them as buckets where your income gets sorted. Each bucket has its own tax rate, and once you hit the limit of one bucket, the rest of your income spills over into the next one. Make sense?

For example, if you’re single and earn $50,000 in 2024, you’ll pay a lower rate on the first chunk of your income and a higher rate on the rest. But—and this is key—you don’t pay the higher rate on all of your income. Just the part that falls into that bracket. It’s called “marginal tax rate,” and it’s a game-changer when it comes to understanding your taxes.

How Do Tax Brackets Work in 2024?

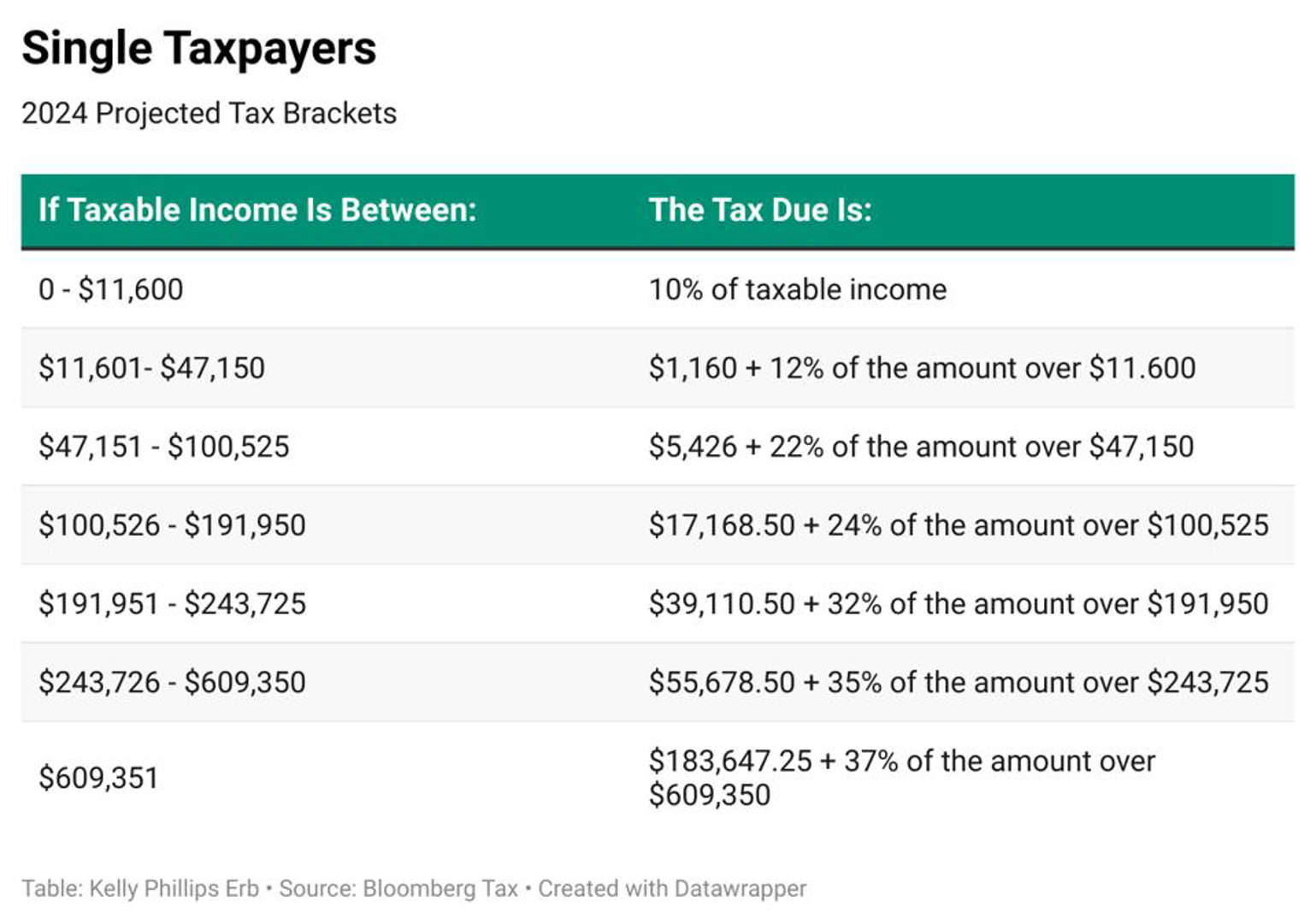

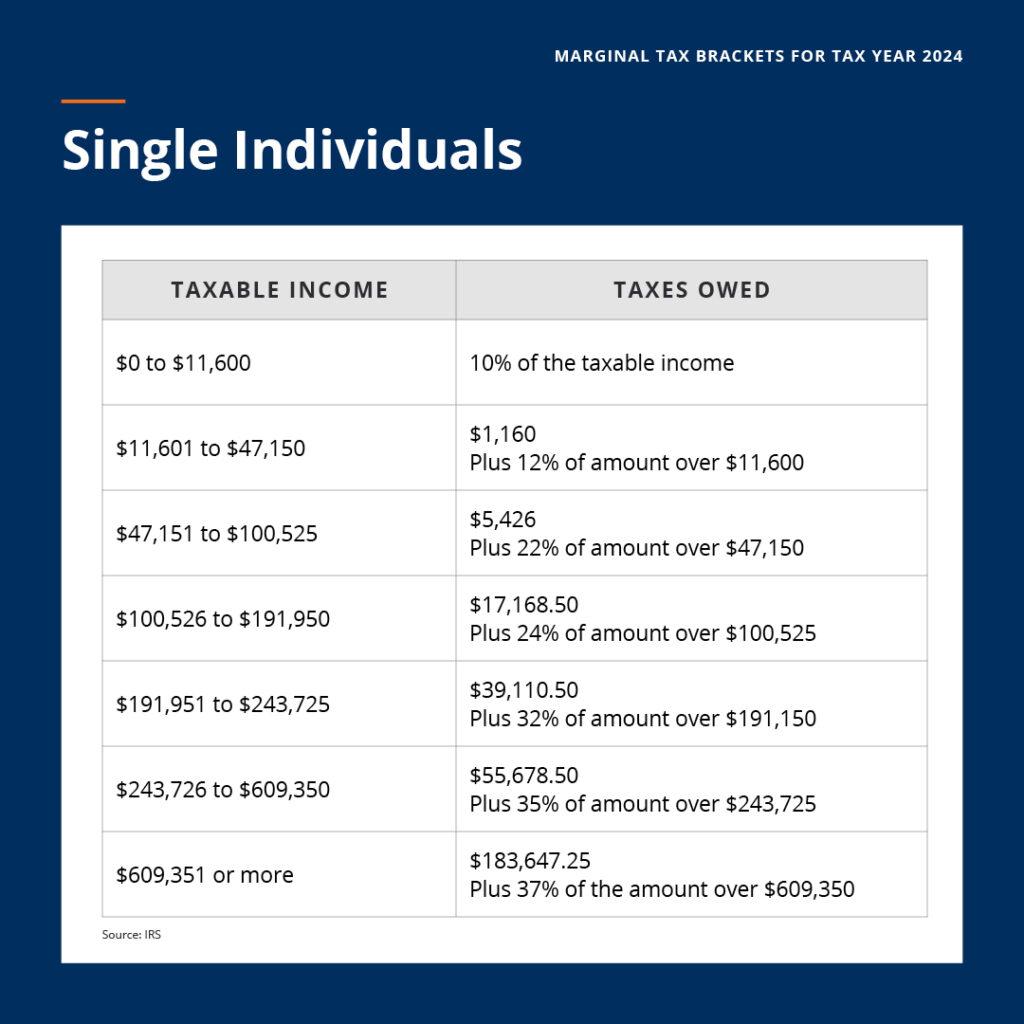

In 2024, the IRS has set new tax brackets based on inflation adjustments. These brackets vary depending on your filing status—single, married filing jointly, married filing separately, or head of household. Here’s a quick rundown:

- Single Filers: The brackets range from 10% on income up to $11,000 to 37% on income over $578,125.

- Married Filing Jointly: The brackets start at 10% for income up to $22,000 and go all the way up to 37% for income over $693,750.

- Head of Household: If you’re the primary caregiver in your home, your brackets are slightly different, starting at 10% for income up to $16,250 and topping out at 37% for income over $578,125.

See? Not so complicated when you break it down. Now, let’s dive deeper into how these brackets affect you.

Why Understanding Tax Brackets Matters

Here’s the thing: knowing your tax bracket isn’t just about math. It’s about strategy. By understanding where you fall in the tax bracket system, you can make smarter financial decisions. For instance, if you’re close to jumping into a higher bracket, you might want to consider ways to reduce your taxable income, like contributing more to a retirement account or taking advantage of tax credits.

Plus, understanding tax brackets can help you avoid common pitfalls. Ever heard of the “tax bracket myth”? That’s the belief that moving into a higher bracket means you’ll pay more taxes on all your income. Wrong! You only pay the higher rate on the income that falls into that bracket. Knowing this can save you from unnecessary stress—and maybe even a few bucks.

Read also:Life After Fame The Struggles Of Matt Lauer In The Hamptons

Common Misconceptions About Tax Brackets

Let’s clear up some of the confusion around tax brackets. Here are a few myths you might have heard:

- Myth #1: Moving into a higher tax bracket means you’ll take home less money. Nope! You’ll only pay the higher rate on the portion of your income that falls into that bracket.

- Myth #2: Tax brackets are the same for everyone. Not true! Your filing status affects your brackets, so a single filer and a married couple filing jointly will have different thresholds.

- Myth #3: Tax brackets are set in stone. Actually, they’re adjusted annually for inflation, so the numbers can change from year to year.

Now that we’ve busted those myths, let’s move on to the good stuff.

2024 Tax Brackets: A Breakdown by Filing Status

Ready for some numbers? Here’s a detailed look at the 2024 tax brackets for each filing status:

Single Filers

10%: Up to $11,000

12%: $11,001 to $44,725

22%: $44,726 to $95,375

24%: $95,376 to $170,750

32%: $170,751 to $215,950

35%: $215,951 to $578,125

37%: Over $578,125

Married Filing Jointly

10%: Up to $22,000

12%: $22,001 to $89,450

22%: $89,451 to $190,750

24%: $190,751 to $341,500

32%: $341,501 to $431,900

35%: $431,901 to $693,750

37%: Over $693,750

Head of Household

10%: Up to $16,250

12%: $16,251 to $55,100

22%: $55,101 to $128,125

24%: $128,126 to $214,350

32%: $214,351 to $264,950

35%: $264,951 to $578,125

37%: Over $578,125

See how the brackets differ depending on your filing status? It’s crucial to know which one applies to you so you can plan accordingly.

Tips for Maximizing Your Tax Savings

Now that you’ve got the basics down, let’s talk about how to make the most of your 2024 tax brackets. Here are a few tips to help you save big:

- Contribute to Retirement Accounts: Max out your 401(k) or IRA contributions to lower your taxable income.

- Take Advantage of Tax Credits: Look into credits like the Child Tax Credit or the Earned Income Tax Credit to reduce your tax bill.

- Plan for Deductions: Keep track of deductible expenses like mortgage interest, charitable donations, and medical expenses.

- Consider Tax-Loss Harvesting: If you’re an investor, selling losing stocks can offset gains and reduce your taxable income.

These strategies can help you keep more of your hard-earned money in your pocket. And who doesn’t love that?

How to Calculate Your Effective Tax Rate

Here’s a quick trick: your effective tax rate is the actual percentage of your income that you pay in taxes. It’s usually lower than your marginal tax rate because of the way brackets work. To calculate it, divide your total tax bill by your total income. Easy peasy!

Changes in Tax Brackets: What to Expect in 2024

Every year, the IRS adjusts tax brackets to account for inflation. In 2024, you’ll notice slight increases across the board. For example, the 10% bracket for single filers has gone up from $10,275 in 2023 to $11,000 in 2024. These small changes can add up, so it’s worth keeping an eye on them.

Another thing to watch out for in 2024 is any potential policy changes. With new legislation always on the table, it’s possible that tax laws could shift. Stay informed by keeping an eye on updates from the IRS and reputable financial sources.

How Inflation Affects Tax Brackets

Inflation plays a big role in shaping tax brackets. As prices rise, the IRS adjusts the brackets to ensure that taxpayers aren’t pushed into higher brackets just because of inflation. This helps prevent what’s known as “bracket creep,” where people end up paying more taxes simply because their income keeps pace with inflation.

Real-Life Examples: How Tax Brackets Impact You

Let’s put all this info into practice with a couple of examples:

Example 1: Single Filer

Meet Sarah, a single filer earning $75,000 in 2024. Based on the brackets, here’s how her taxes break down:

- 10% on the first $11,000 = $1,100

- 12% on the next $33,725 = $4,047

- 22% on the remaining $30,275 = $6,660.50

Total tax bill: $11,807.50

Example 2: Married Filing Jointly

Now let’s look at John and Jane, a married couple filing jointly with a combined income of $150,000:

- 10% on the first $22,000 = $2,200

- 12% on the next $67,450 = $8,094

- 22% on the remaining $60,550 = $13,321

Total tax bill: $23,615

See how the brackets work in action? It’s all about breaking down your income into those tiers.

Final Thoughts: Take Control of Your Taxes

Alright, folks, that’s the lowdown on the 2024 tax brackets. By now, you should have a solid understanding of how they work and how they impact your finances. Remember, knowledge is power, and knowing your tax bracket can help you make smarter financial decisions.

So, here’s the deal: don’t just sit back and wait for tax season to sneak up on you. Start planning now. Look into ways to reduce your taxable income, take advantage of credits and deductions, and stay informed about any changes to tax laws. And if you’re ever unsure, don’t hesitate to consult a tax professional. They’re there to help!

Got any questions or tips of your own? Drop them in the comments below. And if you found this guide helpful, be sure to share it with your friends and family. Let’s spread the tax knowledge and make this year’s tax season a little less stressful for everyone.

Table of Contents

What Are Tax Brackets, Anyway?

How Do Tax Brackets Work in 2024?

Why Understanding Tax Brackets Matters

Article Recommendations