Goldman Sachs Downgrades U.S. Economy: What You Need To Know Right Now

Listen up, folks—Goldman Sachs just dropped a bombshell, and it's got everyone talking. The financial giant has officially downgraded its outlook on the U.S. economy. Yep, you read that right. This isn't some random prediction; it's coming straight from one of the most influential financial institutions in the world. So, what does this mean for you, me, and the rest of the nation? Let's break it down because this is serious stuff that could impact your wallet, your investments, and even your job.

Now, before we dive deep into the nitty-gritty, let's get one thing straight: Goldman Sachs doesn't make moves like this lightly. When they say the U.S. economy is in trouble, people listen—and for good reason. Their analysis is based on hard data, trends, and insights that most of us don't have access to. But don't panic just yet. We're here to unpack this news, explain why it matters, and help you figure out what steps you can take to protect yourself.

Let's face it, the economy can be a confusing beast. One minute it's booming, the next it's crashing. But understanding what Goldman Sachs is saying—and why—is key to staying ahead of the game. Whether you're an investor, a small business owner, or just someone trying to make ends meet, this downgrade could affect you more than you think. So, grab a coffee, settle in, and let's tackle this together.

Read also:Maria Shriver Shares Life Lessons And Reflections In Exclusive Interview

Table of Contents

- Goldman Sachs' Move Explained

- Why Did Goldman Sachs Downgrade the U.S. Economy?

- Key Economic Indicators to Watch

- Impact on Financial Markets

- How This Affects Consumers

- What Businesses Need to Know

- A Look Back at Past Downgrades

- Government Response and Policy Moves

- What You Can Do to Protect Yourself

- Wrapping It All Up

Goldman Sachs' Move Explained

Alright, let's start with the basics. Goldman Sachs recently announced that they're downgrading their outlook on the U.S. economy. In plain English, this means they believe the economy is heading for tougher times. Now, Goldman Sachs isn't just any company—they're a powerhouse in the financial world. Their opinions carry weight, and when they speak, people listen. So, what exactly does this downgrade entail?

Think of it like a weather forecast. Instead of predicting sunshine and rainbows, they're calling for storm clouds on the horizon. They've revised their growth projections, lowered their expectations for key sectors, and signaled that the economic winds might not be as favorable as previously thought.

But here's the kicker: this isn't just about numbers. It's about the ripple effects this downgrade could have across industries, markets, and everyday lives. Let's dig deeper into why they made this call.

What Led to This Decision?

Goldman Sachs didn't pull this downgrade out of thin air. They analyzed a range of factors, including inflation rates, consumer spending, government policies, and global economic conditions. Here's a quick rundown of some of the key drivers:

- Inflation Woes: Rising prices have put a strain on households and businesses alike. Goldman Sachs sees this as a major headwind for economic growth.

- Fed Actions: The Federal Reserve's aggressive interest rate hikes aimed at controlling inflation could slow down the economy more than expected.

- Global Uncertainty: From geopolitical tensions to supply chain disruptions, there's a lot of uncertainty out there that's affecting the U.S. economy.

It's a perfect storm of challenges, and Goldman Sachs isn't shy about pointing them out.

Why Did Goldman Sachs Downgrade the U.S. Economy?

Okay, so we know they downgraded the economy, but why? To answer that, we need to look at the bigger picture. The U.S. economy has been on a rollercoaster ride over the past few years. From the pandemic to inflation, there's been no shortage of challenges. Goldman Sachs sees several red flags that have led them to this decision.

Read also:Giuliana And Bill Rancicrsquos Chicago Mansion Hits The Market

First up, inflation. Prices for everything from groceries to gas have been climbing at an alarming rate. This isn't just annoying—it's eating into people's savings and reducing their purchasing power. Goldman Sachs believes this trend will continue to weigh on the economy.

Then there's the Fed. The central bank has been raising interest rates in an attempt to cool down inflation. While this is a necessary step, it also slows down economic activity. Borrowing becomes more expensive, businesses tighten their belts, and consumers become more cautious. It's a balancing act, and Goldman Sachs thinks the Fed might tip the scales too far in the other direction.

Other Factors at Play

Let's not forget about the global stage. The U.S. economy doesn't exist in a vacuum. What happens in other parts of the world affects us too. Trade tensions, geopolitical conflicts, and supply chain issues all play a role in shaping the economic landscape. Goldman Sachs has factored these into their analysis, and the outlook isn't rosy.

But here's the thing: they're not alone. Other financial institutions and economists are sounding similar alarms. It's not just one opinion—it's a growing consensus that the U.S. economy faces significant challenges ahead.

Key Economic Indicators to Watch

If you want to stay ahead of the curve, you need to keep an eye on certain economic indicators. These are the numbers that tell us how the economy is performing. Goldman Sachs pays close attention to them, and so should you. Here are a few to watch:

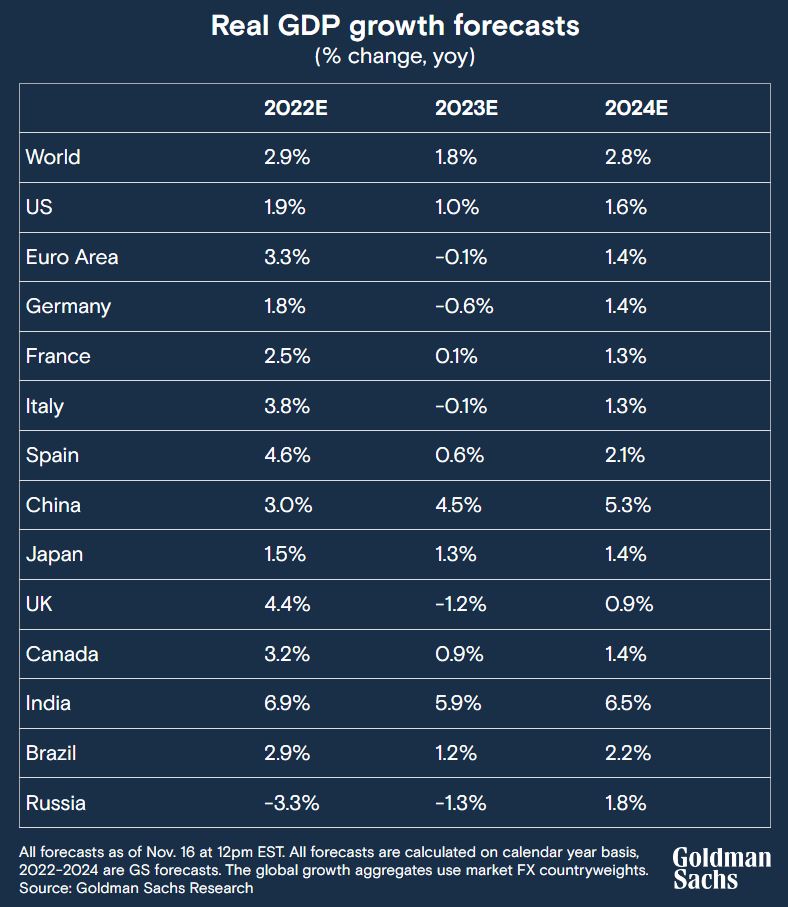

- GDP Growth: This measures the overall health of the economy. If GDP growth slows down, it's a sign of trouble.

- Inflation Rates: As we mentioned earlier, inflation is a big deal. Keep an eye on how prices are moving.

- Unemployment: A rising unemployment rate could signal economic trouble. On the flip side, low unemployment can be a good sign.

- Consumer Confidence: This measures how optimistic people are about the economy. When confidence is high, people spend more. When it's low, they tighten their wallets.

These indicators can give you a pretty good idea of where the economy is headed. And if you're following Goldman Sachs' lead, you'll want to keep a close eye on them.

Impact on Financial Markets

When Goldman Sachs downgrades the U.S. economy, it doesn't just affect Main Street—it also shakes up Wall Street. Financial markets are incredibly sensitive to news like this. Investors start rethinking their strategies, and stock prices can fluctuate wildly. So, what does this mean for you if you're an investor?

First off, volatility is likely to increase. That means more ups and downs in the market. If you're invested in stocks, bonds, or other financial instruments, you might see some turbulence. But here's the thing: volatility isn't necessarily a bad thing. It can create opportunities for savvy investors who know how to navigate the storm.

Goldman Sachs' downgrade could also lead to a shift in investor sentiment. People might start moving their money out of risky assets and into safer ones like government bonds or gold. This could affect the performance of your portfolio, so it's important to stay informed and adjust your strategy accordingly.

What About Cryptocurrencies?

Oh, and let's not forget about crypto. The cryptocurrency market is notoriously volatile, and economic news like this can send shockwaves through it. If investors start pulling out of risky assets, cryptocurrencies could take a hit. On the flip side, some people might see them as a hedge against inflation. It's a wild ride, and Goldman Sachs' downgrade could make it even wilder.

How This Affects Consumers

Now, let's talk about the average person. If you're not an investor or a business owner, you might be wondering how Goldman Sachs' downgrade affects you. The answer is: it could affect you in a lot of ways. Here are a few things to watch out for:

- Higher Prices: Inflation is already squeezing people's budgets, and this downgrade could make it worse.

- Job Market Changes: If the economy slows down, companies might start cutting jobs or freezing hiring. This could impact your career prospects.

- Borrowing Costs: With interest rates on the rise, borrowing money could become more expensive. Whether you're buying a house, a car, or just using your credit card, you might feel the pinch.

But here's the good news: there are steps you can take to protect yourself. We'll get into those later, but for now, just know that staying informed is your best defense.

What Businesses Need to Know

For businesses, Goldman Sachs' downgrade is a wake-up call. It's a signal that the economic environment is changing, and they need to adapt. Here are a few things businesses should consider:

- Cost Management: With inflation and rising interest rates, managing costs becomes even more critical. Businesses may need to find ways to operate more efficiently.

- Investment Strategies: If the economy slows down, businesses might rethink their investment plans. They could focus more on short-term gains rather than long-term growth.

- Customer Engagement: In tough economic times, keeping customers happy is more important than ever. Businesses may need to step up their game to retain loyal customers.

It's a challenging environment, but with the right strategies, businesses can weather the storm. And if they play their cards right, they might even come out stronger on the other side.

Small Businesses vs. Big Corporations

Let's not forget about the little guys. Small businesses often feel the brunt of economic downturns more than large corporations. They have less cushion to absorb shocks, and they rely heavily on consumer spending. Goldman Sachs' downgrade could hit them hard, but it also presents an opportunity to innovate and find new ways to thrive.

A Look Back at Past Downgrades

To understand what's happening now, it helps to look at the past. Goldman Sachs has downgraded the U.S. economy before, and each time, there were lessons to be learned. Let's take a trip down memory lane and see what history can teach us.

Back in the early 2000s, Goldman Sachs warned about the dot-com bubble. They were right, and the tech-heavy Nasdaq crashed, wiping out billions in value. Then there was the 2008 financial crisis. Goldman Sachs saw the warning signs early and adjusted their strategies accordingly. While many firms struggled, they came out relatively unscathed.

The point is, Goldman Sachs has a track record of getting it right. When they downgrade the economy, it's worth paying attention because history shows they often know what they're talking about.

Government Response and Policy Moves

Of course, the government isn't just sitting on the sidelines. When Goldman Sachs downgrades the economy, it often sparks a response from policymakers. They might introduce new programs, adjust existing ones, or even change laws to try and stabilize the economy. So, what can we expect this time around?

One possibility is more stimulus measures. If the economy slows down too much, the government might step in with tax cuts, increased spending, or other forms of support. However, these measures come with trade-offs, and they might not be enough to fully offset the challenges ahead.

Another option is monetary policy. The Federal Reserve could adjust interest rates, tweak reserve requirements, or even implement unconventional measures like quantitative easing. All of these tools are designed to influence the economy, but they come with risks and uncertainties.

Will It Be Enough?

The big question is: will the government's response be enough to counteract the effects of Goldman Sachs' downgrade? Only time will tell. But one thing is certain: the government will be under pressure to act, and the decisions they make could have far-reaching consequences.

What You Can Do to Protect Yourself

Okay, so we've covered a lot of ground. But what does all this mean for you? If you're feeling a little overwhelmed,

Article Recommendations